What are the pros and cons of an emergency cash fund vs relying on a cash loan as a contingency plan?

It’s one of the most commonly touted pieces of financial advice – always have an emergency cash fund, equivalent to 6 months’ income, stashed away for a rainy day. This emergency fund should be liquid, meaning that you can withdraw it within short notice.

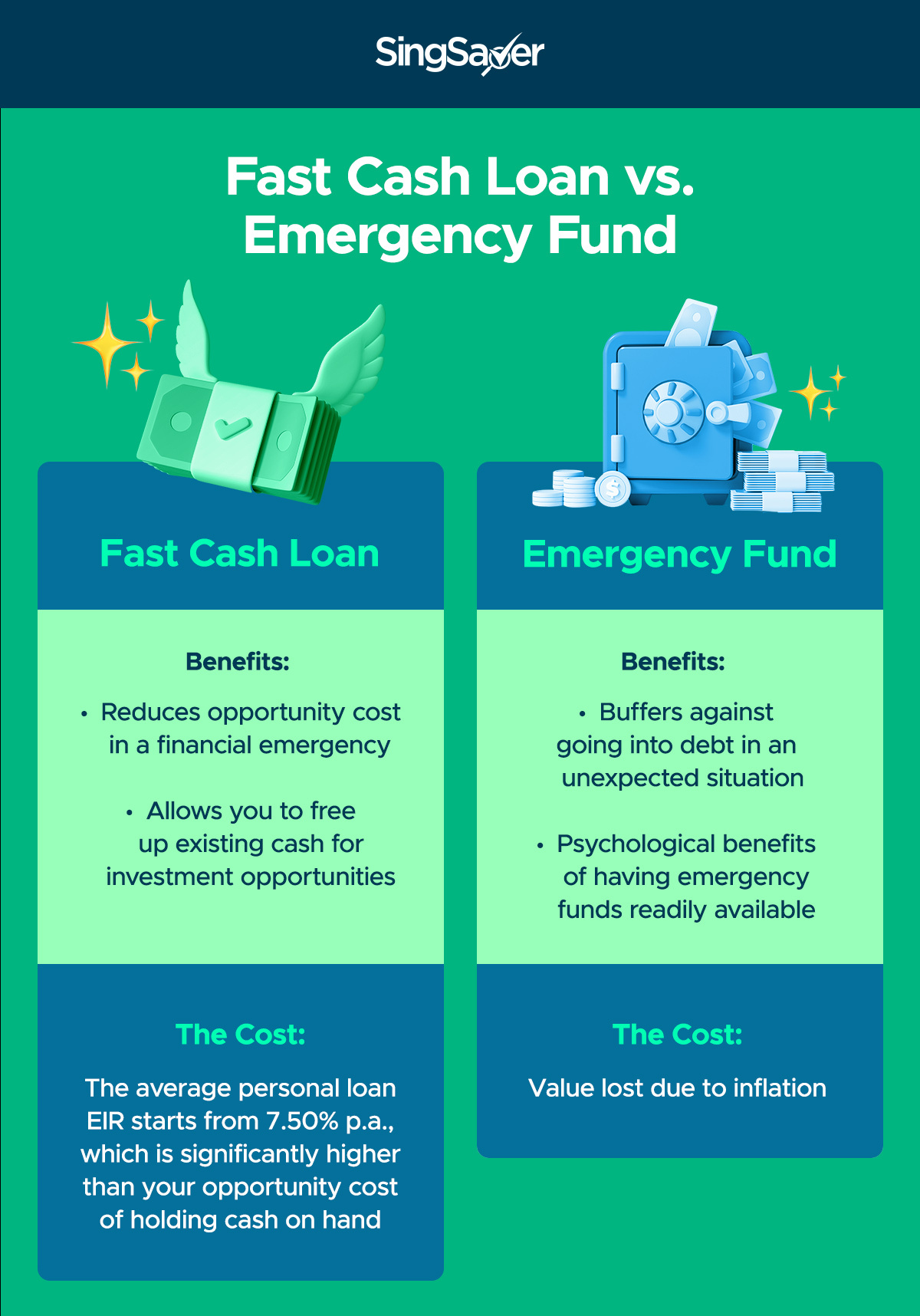

But is it really the best approach to having so much cash tucked away, losing its value to inflation? We weigh the pros and cons of having an emergency fund versus access to an instant loan.

Emergency Fund: The traditional “money in your mattress” contingency plan

The Benefits

The most obvious financial benefit of an emergency fund is that it can help you buffer against going into debt should an unexpected situation arise. Staying out of debt can be helpful if you’re trying to reach certain life goals such as retirement or home ownership.

There is also a psychological benefit of having an emergency cash fund to cushion against the blow of life’s unforeseen circumstances. Some people sleep better knowing that they have cash tucked away in their mattress, figuratively speaking.

The Costs

The main cost of having an emergency cash fund is that it will literally cost you – in value lost due to inflation. Singapore’s core inflation rate in 2018 was 1.7%, and is expected to be even higher in 2019, which means that you can expect your emergency fund of S$30,000 to be worth significantly less in 10 years.

This doesn’t mean you shouldn’t have an emergency fund, but it does mean that you shouldn’t be holding on to too much cash beyond what you absolutely need.

Fast Cash Loan: An alternative that helps reduce opportunity cost

The Benefits

The key benefit of using cash loans in the event of a financial emergency is that you reduce your opportunity cost.

Opportunity cost is an economic term that refers to the cost of making one decision over another. A simple example would be that if you spend two hours at night streaming Netflix, your opportunity cost is two hours of sleep.

In the case of idle cash balances, the opportunity cost is the loss in terms of interest you would have earned if you had conservatively invested it instead.

Read more: Is Investing Better Than Saving Money?

One example of a conservative investment is time deposits – UOB and HSBC are offering promotional rates of 1.70% p.a. if you commit fresh funds of S$20,000 for a minimum of 10 months.

Another example of a conservative investment is a Singapore Savings Bond, for which you can earn an estimated 2.16% p.a. If you commit to a full maturity period of 10 years (calculated based on an investment amount of S$20,000 starting 2 May 2019 and maturing 1 May 2029).

If you’re savvy enough to invest your own funds, your interest earned per annum could potentially be even higher. And even if you’re not, robo-advisors like StashAway and AutoWealth are a great – and relatively safe – alternative to trading your own funds.

The point is – having a fast cash loan as your contingency plan allows you to free up your existing cash for investment opportunities. Investing your cash instead of holding it for an emergency fund could help counter the devaluing effects of inflation.

In the event that you urgently need cash, Standard Chartered's instant loan approval and disbursement will help you save valuable time. Read our full review of the Standard Chartered CashOne Personal Loan here to help you decide if it's the right one for you.

SingSaver Exclusive: In the event that you decide to take up the Standard Chartered CashOne Personal Loan before 31 May 2019, be sure to do so via our promotion page and receive $100 bonus cash + a chance to win an extra $1,000 in prize money!

The Costs

The average personal loan effective interest rate (EIR) starts from 7.50% p.a., which is significantly higher than your opportunity cost of holding cash on hand instead.

Which is the better option for you?

Naturally, the answer depends on your personal preferences and appetite for risk.

Hypothetically, if you had S$30,000 in spare cash, which option will appeal more to you: holding it in a savings account, or investing it to earn interest?

To answer that, it helps to consider the situations for which you built your emergency fund in the first place.

What constitutes an emergency could vary from person to person, but this usually means an unexpected medical expense, sudden job loss, or urgent housing repairs.

Medical expenses: In the event of unexpected medical expenses, the average Singaporean would benefit more from investing in a good insurance plan than saving a huge chunk of cash to pay for medical bills. In the words of The Woke Salaryman, "What’s the point of having $100,000 when you’re going to blow all of that (and even more) on chemo." Having an insurance plan and holding just enough cash to pay for your co-payment or deductible (if any) should be good enough.

Sudden job loss: This is a tough one. If you have dependents to look after, a mortgage to pay, and high fixed monthly expenses, then having enough cash to tide you over your unemployment period is important. If you can slash your living expenses and save more during your unemployment period, a nominal amount of S$10,000 might be more than enough to keep you alive till you find your next job.

Urgent housing repairs: Assuming that you are still earning an income, urgent housing repairs can be paid with alternative means other than cash. 0% interest balance transfers are an option; they have a significantly lower EIR than personal instalment loans. The average cost of housing repairs also average around the low thousands, and if you have home insurance, that cost will mostly be covered.

Having cash on hand is a must. How much cash, on the other hand, is up to you. In certain situations, 6 months' salary may be too much cash to have sitting idle.

Editor's note: this article was first published in April 2019, and updated on 2 May 2019.

Read these next:

Your Go-To Personal Loans Guide in Singapore

3 Best Personal Loans in Singapore with the Lowest Interest Rates

When to Use a Personal Loan for Education

3 Best Places to Keep Your Emergency Fund in Singapore

5 Emergency Expenses You’re Probably Not Prepared For

Similar articles

5 Money Lessons Singaporeans Can Learn From Mustafa Centre

How To Buy The Best Mattress In Singapore (2022)

CPF Investment Scheme (CPFIS): Guide To Investing With Your CPF

Best US Exchange Traded Funds (ETFs) To Invest In (2021)

Best Credit Cards To Buy Tickets For Dota 2’s The International 2022

RedMart Promo Codes And Vouchers (January 2023)

Which Credit Card Is The Best Companion For VTL Travel?

7 Golden Rules to Managing Your Money Like An Adult