Most people check their credit card statement every month. But it’s just as important to check your credit card points!

In a perfect world, your credit card transactions and points would always tally nicely. Spend S$100 at a merchant with a 4 miles per dollar card? Expect 400 miles to be credited to your account.

Unfortunately, because of vagaries surrounding Merchant Category Codes (will dining in a hotel code as restaurant spend, or hotel spend?), differences between transaction and posting dates, and discrepancies in back-end coding (online transactions sometimes code as offline), periodically checking your credit card points breakdown is a necessary aspect of miles game hygiene.

The good news is that it doesn’t have to be a thankless chore. While tracking credit card points used to involve creating your own spreadsheets and long calls with customer service, many banks have simplified the process by making breakdowns available online.

BOC Limited-Time Offer: Get up to 3% cash rebate with the BOC SplendorPlus Card (up to 1% in Chinese mainland and up to 3% locally and overseas, excluding Chinese mainland) or enjoy unlimited 1.5% cashback outside the Chinese mainland with the BOC Zaobao Credit Card. Plus, receive a 10GB eSIM and complimentary RMB60 Alipay credit when you apply. Valid till 31 March 2026. T&Cs apply.

Which banks provide credit card points breakdowns?

Before we begin, here’s a brief summary of which banks provide credit card points breakdowns:

If your credit card is from Bank of China, HSBC, or Maybank, only points totals are provided at the moment.

Points balances can be checked either through the mobile banking app or the desktop online banking portal, depending on the bank.

American Express

American Express has two main types of rewards currencies: Membership Rewards Points, and HighFlyer Points/KrisFlyer miles.

The approach is different depending on which one you want to check.

Membership Rewards Points

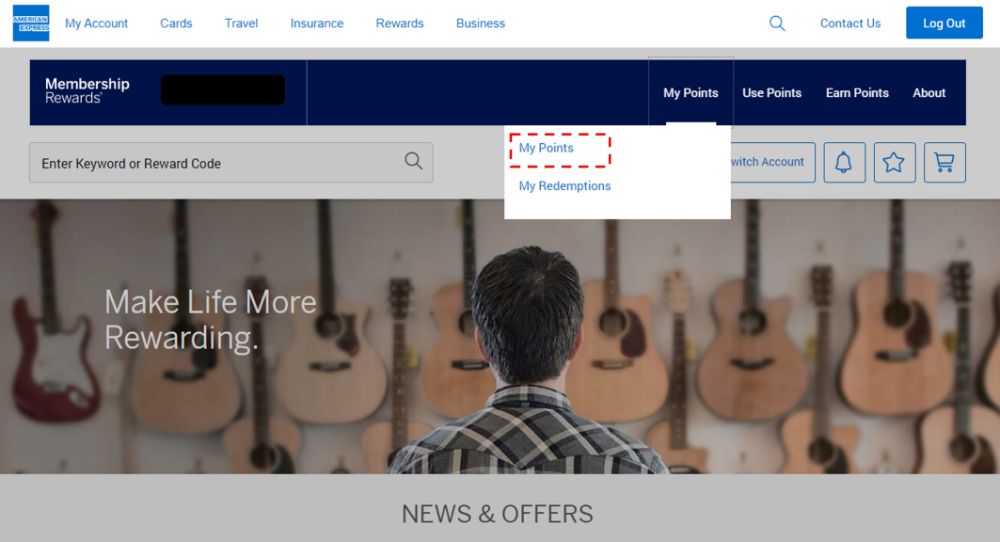

(1) Login to your AMEX account

(2) Select the card you wish to view in the top right hand corner

(3) Click on "Use Points"

(4) Click on "My Points"

(5) Use the drop down menu on the left to see different time periods. Breakdowns can be viewed for the past 12 months.

KrisFlyer/HighFlyer points

KrisFlyer/HighFlyer points breakdowns can only be viewed on the AMEX Mobile App.

(1) Login to your account

(2) Select the card you wish to view

(3) Tap "Membership" at the bottom of the screen

(4) Tap "View Activity"

(5) You'll see a breakdown of points earned in the previous statement period (you can't go back further than that, sadly).

Unfortunately, this interface only shows you the points, not the transaction amount. This makes reconciliation somewhat more troublesome.

Looking for the best credit cards to complement your spending patterns and expenditure in 2025? Check out our Ultimate Credit Card Guide that covers all things credit cards in Singapore – from choosing between a cashback, miles, or rewards credit card to planning your credit card strategy.

Looking for the best credit cards to complement your spending patterns and expenditure in 2025? Check out our Ultimate Credit Card Guide that covers all things credit cards in Singapore – from choosing between a cashback, miles, or rewards credit card to planning your credit card strategy.

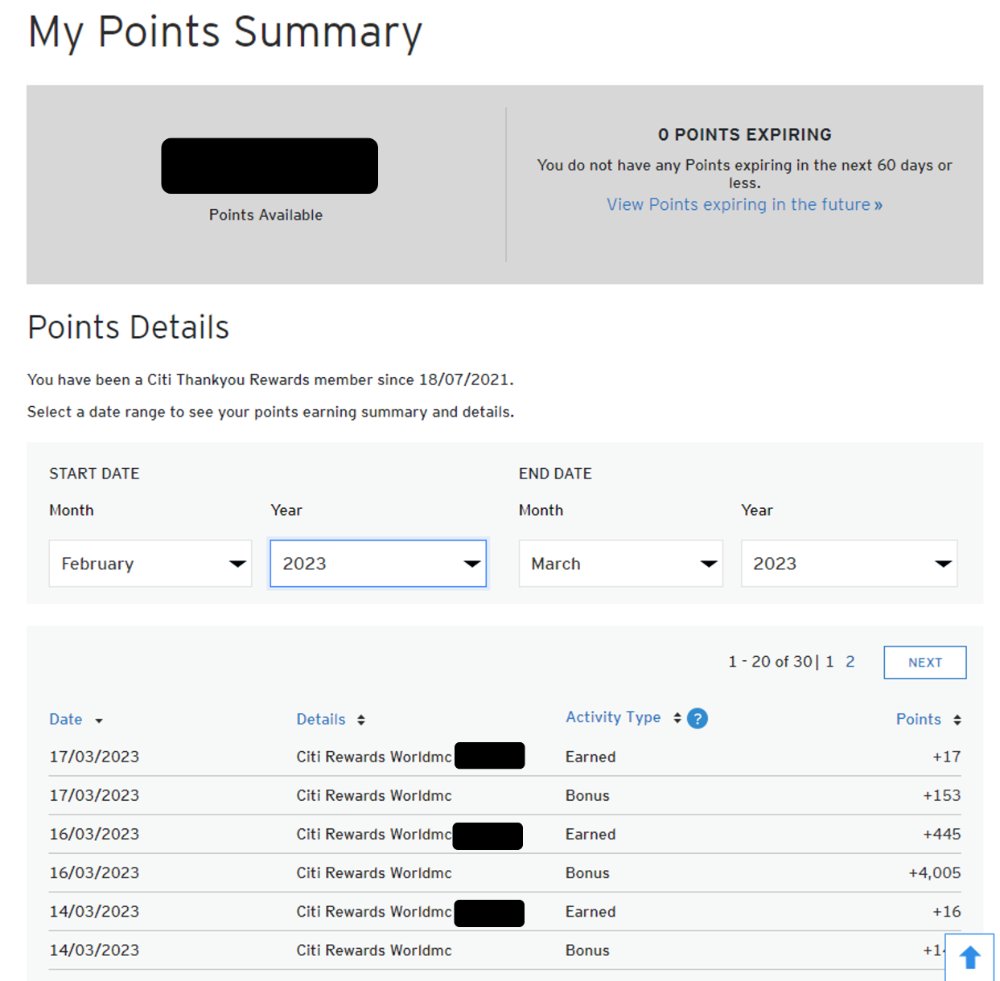

Citibank

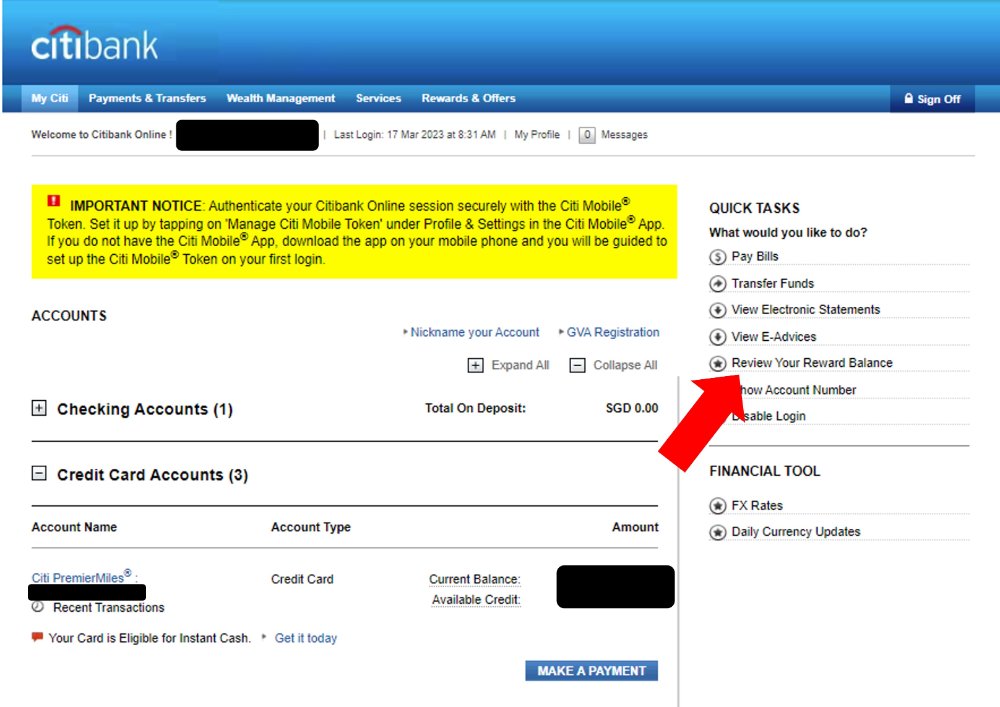

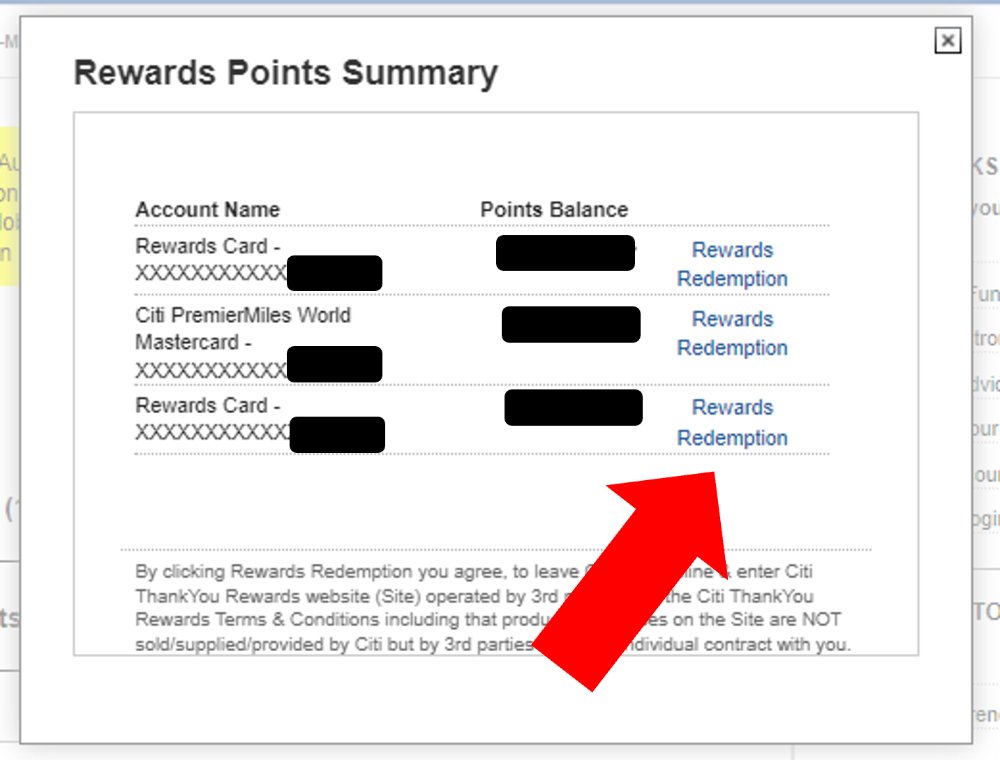

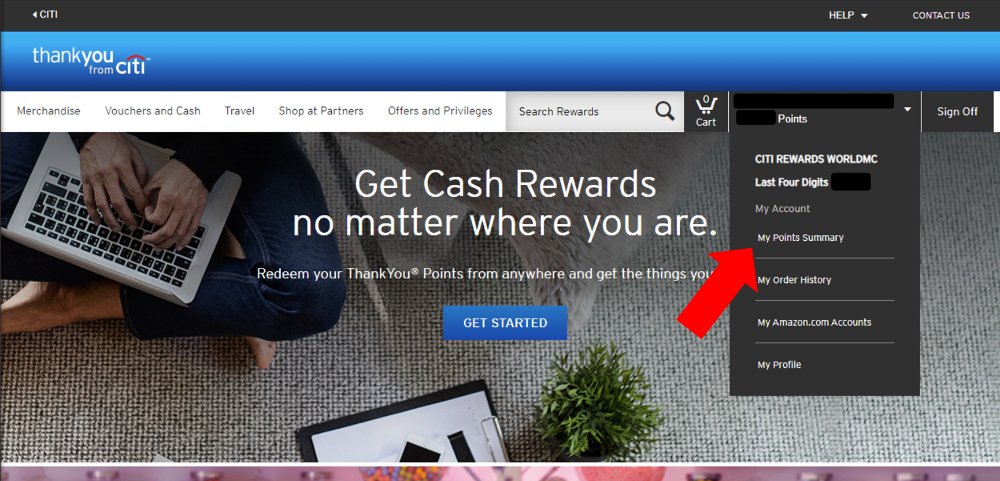

While Citibank provides points breakdowns, it’s a little bit messy because transactions are batched and consolidated by day, instead of by transaction. If you use your card several times a day, it may be tricky to work out which transactions did and did not earn a bonus.

(1) Login to your Citibank account

(2) Click "Review Your Reward Balance"

(3) Click "Rewards Redemption" next to the card account you wish to view

(4) Hover the mouse over your name and points balance on the top right hand corner. Click on "My Points Summary"

(5) You can view your points breakdown all the way back to the date you opened your account

SingSaver Exclusive Offer: Receive the following rewards when you sign up for a Standard Chartered Journey Credit Card:

Grab 12,000 Max Miles (worth a round trip to Kuala Lumpur with the travel value at S$210+), S$180 cash, an Apple AirPods 4 (without Active Noise Cancellation) (worth S$199), or a Samsonite Straren Spinner 67/24 (worth S$600) when you apply for a Standard Chartered Journey Credit Card via SingSaver, spend a minimum of S$800 within 60 days of card approval, pay the annual fee, and apply for one of these products: EasyPay, Bonus$aver Account, CashOne, or CCFT. Valid till 31 March 2026. T&Cs apply.

SingSaver Exclusive Offer: Receive the following rewards when you sign up for a Standard Chartered Journey Credit Card:

Grab 12,000 Max Miles (worth a round trip to Kuala Lumpur with the travel value at S$210+), S$180 cash, an Apple AirPods 4 (without Active Noise Cancellation) (worth S$199), or a Samsonite Straren Spinner 67/24 (worth S$600) when you apply for a Standard Chartered Journey Credit Card via SingSaver, spend a minimum of S$800 within 60 days of card approval, pay the annual fee, and apply for one of these products: EasyPay, Bonus$aver Account, CashOne, or CCFT. Valid till 31 March 2026. T&Cs apply.

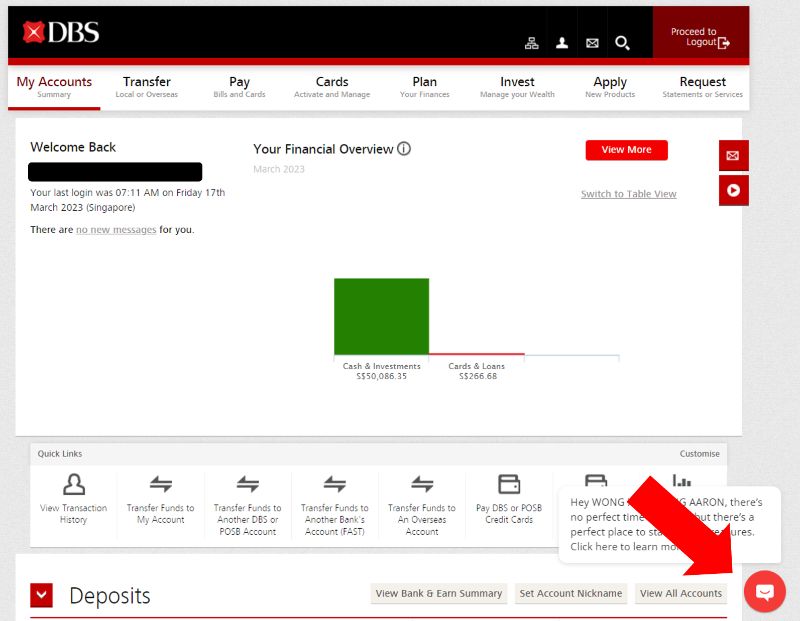

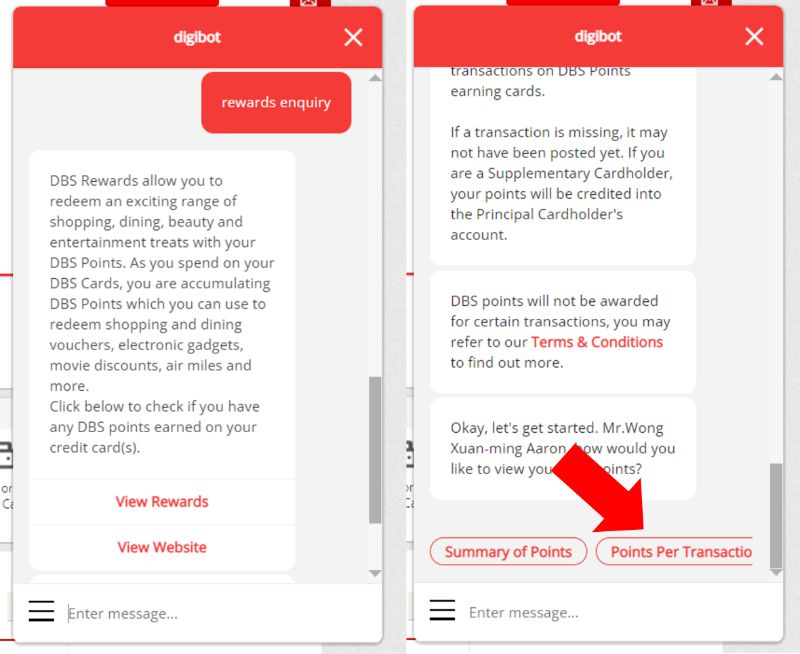

DBS

DBS allows you to check points breakdowns via the DBS Virtual Assistant.

(1) Login to your DBS account

(2) Click the Virtual Assistant icon at the bottom right hand corner

(3) Type "Rewards Enquiry" and click "View Rewards" ➤ "Points Per Transaction"

(4) You will now see the points awarded per transaction. Click on "See More" to populate additional entries

For bonus points, look for a consolidated entry labelled "Ecom" (e-commerce). It's not disaggregated, however, so you'll still have some work to do.

Do note that for whatever reason, not every DBS user will see the "Ecom" entry, even if they have eligible bonus transactions.

In that case, you'll have to call up customer service to check your bonus points.

Looking for the best credit cards to complement your spending patterns and expenditure in 2025? Check out our Ultimate Credit Card Guide that covers all things credit cards in Singapore – from choosing between a cashback, miles, or rewards credit card to planning your credit card strategy.

Looking for the best credit cards to complement your spending patterns and expenditure in 2025? Check out our Ultimate Credit Card Guide that covers all things credit cards in Singapore – from choosing between a cashback, miles, or rewards credit card to planning your credit card strategy.

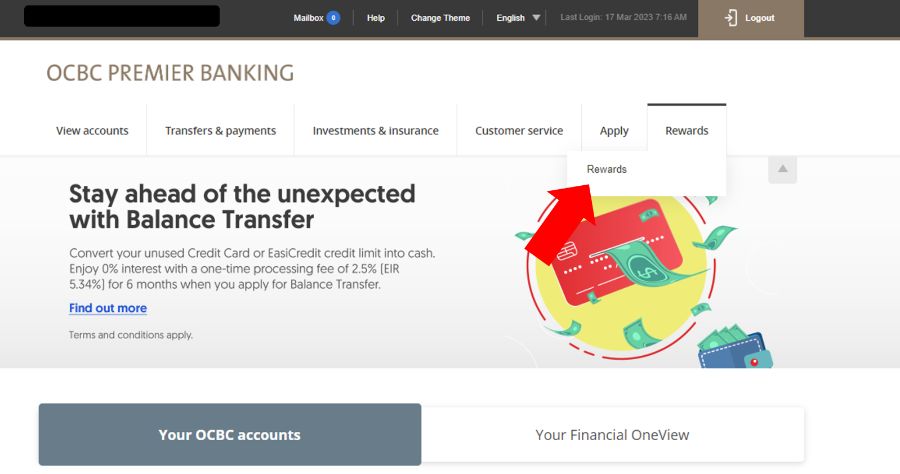

OCBC

While OCBC provides transaction-level points breakdowns, they use reference numbers rather than merchant names for tracking, so it's far from intuitive. You'll need to cross refer to your card statement to figure out which transaction is which.

(1) Login to your OCBC account

(2) Hover your mouse over "Rewards", then click "Rewards"

(3) Click on "Transaction History"

(4) Click on the reference number of the transaction you want to investigate

(5) Scroll down and see the points awarded on this transaction

SingSaver Exclusive Offer: Receive the following rewards when you sign up for a Standard Chartered Journey Credit Card:

Grab 12,000 Max Miles (worth a round trip to Kuala Lumpur with the travel value at S$210+), S$180 cash, an Apple AirPods 4 (without Active Noise Cancellation) (worth S$199), or a Samsonite Straren Spinner 67/24 (worth S$600) when you apply for a Standard Chartered Journey Credit Card via SingSaver, spend a minimum of S$800 within 60 days of card approval, pay the annual fee, and apply for one of these products: EasyPay, Bonus$aver Account, CashOne, or CCFT. Valid till 31 March 2026. T&Cs apply.

SingSaver Exclusive Offer: Receive the following rewards when you sign up for a Standard Chartered Journey Credit Card:

Grab 12,000 Max Miles (worth a round trip to Kuala Lumpur with the travel value at S$210+), S$180 cash, an Apple AirPods 4 (without Active Noise Cancellation) (worth S$199), or a Samsonite Straren Spinner 67/24 (worth S$600) when you apply for a Standard Chartered Journey Credit Card via SingSaver, spend a minimum of S$800 within 60 days of card approval, pay the annual fee, and apply for one of these products: EasyPay, Bonus$aver Account, CashOne, or CCFT. Valid till 31 March 2026. T&Cs apply.

Standard Chartered

Standard Chartered’s new rewards portal allows customers to track transaction-level points breakdowns, with a limit of up to three months.

(1) Login to your Standard Chartered account

(2) Click on your name on the top right, then "Transaction History"

(3) Choose which card you want to see a breakdown for. Points breakdowns can be viewed for up to three months.

SingSaver Exclusive Offer: Receive the following rewards when you sign up for a Standard Chartered Journey Credit Card:

Grab 12,000 Max Miles (worth a round trip to Kuala Lumpur with the travel value at S$210+), S$180 cash, an Apple AirPods 4 (without Active Noise Cancellation) (worth S$199), or a Samsonite Straren Spinner 67/24 (worth S$600) when you apply for a Standard Chartered Journey Credit Card via SingSaver, spend a minimum of S$800 within 60 days of card approval, pay the annual fee, and apply for one of these products: EasyPay, Bonus$aver Account, CashOne, or CCFT. Valid till 31 March 2026. T&Cs apply.

SingSaver Exclusive Offer: Receive the following rewards when you sign up for a Standard Chartered Journey Credit Card:

Grab 12,000 Max Miles (worth a round trip to Kuala Lumpur with the travel value at S$210+), S$180 cash, an Apple AirPods 4 (without Active Noise Cancellation) (worth S$199), or a Samsonite Straren Spinner 67/24 (worth S$600) when you apply for a Standard Chartered Journey Credit Card via SingSaver, spend a minimum of S$800 within 60 days of card approval, pay the annual fee, and apply for one of these products: EasyPay, Bonus$aver Account, CashOne, or CCFT. Valid till 31 March 2026. T&Cs apply.

UOB

UOB probably has the best points tracking system of all. It’s natively integrated to the mobile banking app, and it even breaks out points into base and bonus so you know whether you’re earning the correct number of points in total.

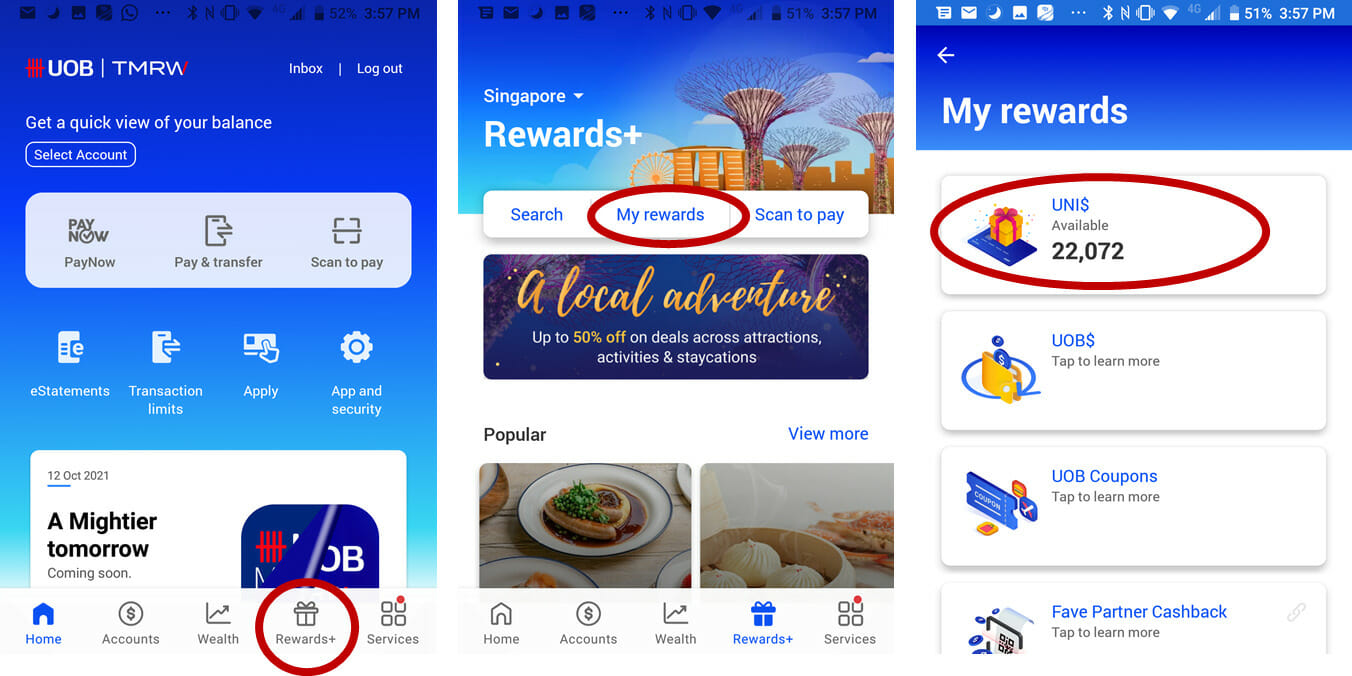

(1) Login to the UOB TMRW app and tap Rewards+ ➤ My Rewards ➤ UNI$

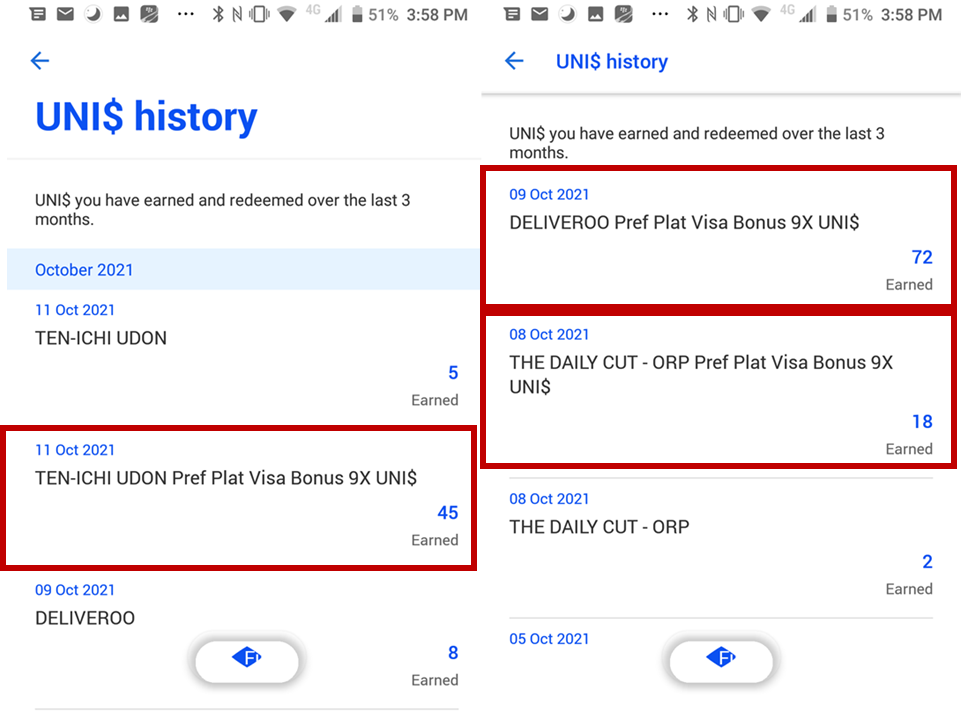

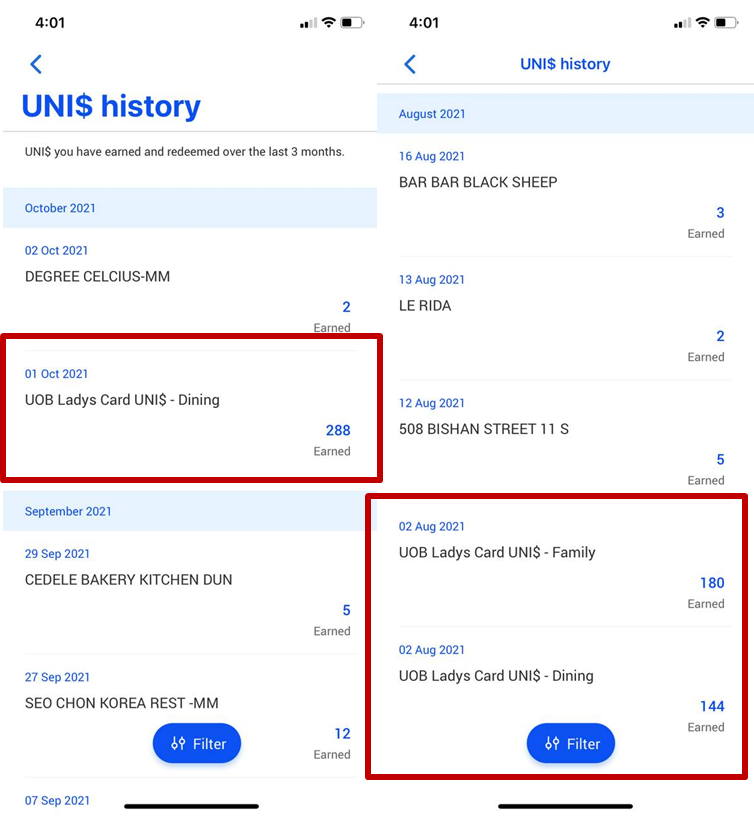

(2) You'll see a breakdown under the UNI$ history section (tap "view all" to see more), for the past three months.

If you spend using the UOB Preferred Platinum Visa, you'll see a transaction-level bonus entry.

If you use the UOB Lady's Card, UOB Lady's Solitaire or UOB Visa Signature, you'll see a consolidated monthly bonus entry at the start of each month.

Looking for the best credit cards to complement your spending patterns and expenditure in 2025? Check out our Ultimate Credit Card Guide that covers all things credit cards in Singapore – from choosing between a cashback, miles, or rewards credit card to planning your credit card strategy.

Looking for the best credit cards to complement your spending patterns and expenditure in 2025? Check out our Ultimate Credit Card Guide that covers all things credit cards in Singapore – from choosing between a cashback, miles, or rewards credit card to planning your credit card strategy.

Conclusion

If your credit card is issued by Bank of China, HSBC and Maybank, you'll still need to call up customer service if you suspect your points tally isn't correct.

Fortunately, it’s a simple enough matter to check your points balances with other banks, and I’d encourage you to do so at least once a month to make sure everything is in order.

If you do see missing points, it’s worth contacting customer service to see what went wrong. I personally had a few transactions on my DBS Woman’s World Card that should have earned 4 miles per dollar (by virtue of being online) but didn’t.

Upon checking with the bank, I was told that the back-end indicators showed it was processed offline, but if I could submit proof it was done online (e.g. an email receipt) then they could credit the points manually. I did so, and the correct points were credited.

Taking a few minutes to check your points each month can prevent a lot of heartache down the road. Start forming good habits!

Read these next:

Best Credit Card Combinations for Post-Covid Travel

Best American Express Credit Cards In Singapore (2023)

Miles Credit Card Comparison: What’s Good For First-Time Miles Chasers?

Similar articles

Best Short-Term Personal Loans in Singapore

Which Banks Pool Credit Card Points?

How Can I Earn Miles And Points On Insurance Payments?

Standard Chartered Smart Credit Card Review: Up to 10% Cashback for Streaming, Casual Dining and Transport

Standard Chartered Visa Infinite Card Review: When The Good Life® Becomes The Suite Travel Life

Standard Chartered Rewards+ Review: Accelerated Points For Foreign & Dining Spends

EZ-Link vs EZ-Reload vs SimplyGo: Best App + Card To Pay For Public Transport in Singapore

How to Use the Standard Chartered Journey Credit Card to Get a Free Flight to Korea (Worth 54,000 Miles)

%20(2).jpg?width=680&name=KOLs%20(Mile%20Lion)%20(2).jpg)