What Happens If, a SingSaver series, lays bare all the likely personal finance scenarios that could hit you at any stage of your life. After all, it never hurts to be prepared.

What happens if you really do get tested positive for COVID-19? Here’s a look at what the government and insurance companies are covering.

Overseas travel came to a grinding halt in March and is still recovering at a glacial pace in 2021. With the SingapoRediscovers vouchers, locals are encouraged to spend domestically on 'travel' here in our little red dot.

We've previously looked at whether your travel insurance will cover COVID-19 and also shared 10 things you can do with your travel fund. Beyond travel, COVID-19 has brought about a 'new norm' in our daily lives, with Singaporeans getting accustomed to working from home, having food delivered and stepping out of our homes with a mask on.

With the Delta variant causing COVID-19 cases to rise yet again in other countries, the risk of the virus still remains despite our efforts to ring-fence the cases and keep community numbers low. Vaccination efforts have also been ramped up, with the aim of fully vaccinating two-thirds of the population by National Day on 9 August 2021.

Having been through two months of the Circuit Breaker in 2020 and 1.5 months of Phase 2 (Heightened Alert) in 2021, it’s not surprising that many of us are cautious about the opening up of our economy and the launch of travel bubbles.

Here, we take a look at what the Singapore government will compensate you for as well as the additional COVID-19 coverage being provided by insurance companies.

- How much COVID-19 costs

- COVID-19 Tests: PCR tests, ART self-test

- Stay-Home-Notice (SHN)

- Quarantine order

- Getting COVID-19

- Do you need additional COVID-19 coverage

- Free COVID-19 coverage from insurers

- Personal accident plans covering COVID-19

- Travel insurance plans covering COVID-19 (inbound/outbound)

How much COVID-19 costs

With COVID-19 being a highly infectious disease, there are various layers of safety nets the government has set in place to reduce the spread of the virus.

#1 COVID-19 testing fees

Polymerase Chain Reaction (PCR) test:

To check if you have COVID-19, you will need to take a Polymerase Chain Reaction (PCR) test, also referred to as a swab test. This test can be done at numerous clinics all across Singapore and different clinics have different charges for the COVID-19 PCR test.

A swab test could be required:

- If you see a doctor and show symptoms similar to COVID-19

- Before leaving Singapore — pre-departure COVID-19 PCR test

- Upon arrival in Singapore — on-arrival PCR or ART test

- While serving Stay-Home Notice (SHN), you'll be swabbed at specified testing facilities in Singapore at a cost of S$125 that's paid during your application for entry into Singapore

- If you're invited by the Ministry of Health (MOH) to take a COVID-19 test because you live or have visited a place that has seen numerous COVID-19 cases. In such a scenario, do follow MOH’s instructions on the testing requirements. These could be made mandatory, or at times, voluntary but strongly encouraged.

From 17 June 2020, all travellers, inbound and outbound, will be required to pay for their COVID-19 tests, where applicable.

If you're traveling out of Singapore, the country you're visiting might require that you take a pre-departure test. If you're required to take a COVID-19 test, you can do so at any of these clinics here. This can cost up to S$200 if it's PCR-only, with an additional cost tacked on if you need a serology test for trips to China. Prices have been slowly dropping since the tests were introduced, but they still cost a pretty penny.

However, there's good news yet. If you're booking an international flight or hotel through Traveloka from now till 31 December 2021, to enjoy a special rate of S$150 or S$180 (for flights to China) for the pre-departure COVID-19 PCR Swab test.

- Singapore citizens, PRs and long term pass holders:

The Singapore government has been bearing the costs of the majority of COVID-19 tests, with the exception of those who left Singapore from 27 March 2020. However, from 17 June 2020, all inbound and outbound travellers will be required to pay for their COVID-19 tests. The cost of each test is up to S$200.

When seeing a doctor if you’re feeling unwell, the GP might perform a swab test on you at their clinic if you are assessed to have symptoms that suggest a COVID-19 infection. This is also dependent on whether your GP is participating in the Swab and Send Home (SASH) initiative. Otherwise, you could be referred to another Public Health Preparedness Clinics (PHPCs) where SASH is available. The cost of the swab test in such a scenario will be fully covered by the government.

There are also other times when MOH will bear the costs of these tests, such as cases of the recent clusters around Bukit Merah and 91 Henderson Road where testing was made free and compulsory.

- Foreigners:

Since 17 June 2020, all inbound and outbound travellers have been required to pay for their COVID-19 tests.

From 17 November 2020, inbound travellers that are foreigners (except those from lower-risk countries/regions), will need to take a COVID-19 PCR test within 72 hours before their departure from their home country. They will still be required to serve their SHN upon arrival in Singapore and be tested at the end of their SHN.

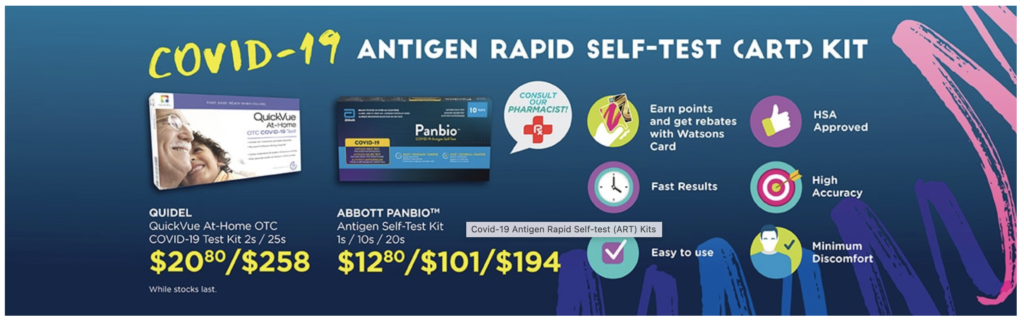

Antigen Rapid Tests (ART) self-test kits:

Made available from 16 June 2021, you can now purchase self-testing kits from designated local retail pharmacies without a doctor's prescription. These self-testing kits will also be made available at more retail locations progressively and you are advised only to use test kits that have been authorised by HSA.

These ART self-test kits are made for individuals who are worried that they may have COVID-19 and take less than 20 minutes to administer.

A quick check on Watsons shows that the price of one kit costs around S$10 and are slightly cheaper when you buy larger packs.

FAQs with regards to the ART self-test kits can be found here.

#2 Stay-Home-Notice (SHN)

All inbound travellers are required to serve a 14-day (or 7-day) SHN upon arrival in Singapore. These travellers will also be tested for COVID-19 at the end of their SHN.

From 1 Jan 2021, costs of stay at dedicated SHN facilities for Singapore citizens and PRs will no longer be waived for those that last left Singapore before 27 March 2020.

The SHN period, place of residence and swab requirements will differ depending on your travel history and the safe travel lane used to enter Singapore. Travellers from low-risk countries will have a shorter SHN duration of seven days instead of the usual 14 days.

Do note that the Government can extend and shorten the duration as needed. In end-April, a 7-day extension (to 21 days) was imposed after clusters began to emerge. However, from 23 June 2021, new travellers arriving from high-risk countries and regions will have their SHN cut to 14 days, which will be served at dedicated facilities. On top of the PCR tests travellers have to take on arrival and on Day 14, they must now also take the ART using a self-test kit on the 3rd, 7th and 11th day after arriving in Singapore.

Naturally, the cost and rules change as well, so be sure to stay abreast of what's going on globally.

There are two types of SHN:

- SHN at your own place of residence

Singaporeans and PRs are allowed to carry out the SHN at your place of residence or a self-sourced residence (non-residential), if you are coming into Singapore from a low-risk country. You will still be tested for COVID-19 at the end of your SHN.

Do keep in mind that if you’re under SHN, you must remain in your place of residence at all times. Your whereabouts will be closely monitored through electronic monitoring as well as physical spot-checks. Breaching SHN requirements comes with heavy penalties, such as having your work pass revoked.

- SHN in a dedicated SHN facility (SDF)

If you’re not travelling from a low-risk country or if you do not have a place of residence, you will have to carry out your SHN at a dedicated SHN facility.

As of 30 December 2020, the cost of SDF stay (inclusive of GST), is about $2,000 per person for accommodation and food. The cost is slightly lower at S$1,300 per person for two adults. This does not include the charges for COVID-19 tests. You will have to pay for your stay at dedicated SHN facilities.

Also, since 1 January 2021, the cost of staying at dedicated SHN facilities for Singaporeans and PRs who last left Singapore before 27 March 2020 will no longer be waived.

You will have to take (and pay for) a COVID-19 test before the end of your SHN at a designated community testing facility.

#3 Quarantine order

If you’re put on Quarantine Order (QO), this could be due to you being a close contact of someone who has or is suspected to have COVID-19.

This quarantine can usually be done in your place of residence, but can also be served in dedicated Government Quarantine Facilities or hospitals. There will be a home quarantine package provided. If you are under quarantine, you are not allowed to come into contact with anyone else. You will have to monitor your health closely and there will be close surveillance on your whereabouts.

To help you defray the costs, there are insurance plans on the market that provide quarantine allowance.

#4 Getting COVID-19

All patients suspected of having COVID-19 must be admitted to hospitals for isolation and management to prevent community transmission. Patients have been conveyed to hospitals such as the National Centre for Infectious Diseases (NCID), Ng Teng Fong General Hospital (NTFGH) and Khoo Teck Puat Hospital (KTPH).

- Singapore citizens, PRs and long term pass holders

In February 2020, the Ministry of Health (MOH) announced that the Singapore Government is paying for hospital bills incurred by COVID-19 patients in public hospitals. Since 7 March 2020, this was changed to only apply to Singapore citizens, PRs and long term pass holders.

On 24 March 2020, the government announced that Singaporeans, PRs and long term pass holders who leave Singapore from March 27 2020 will be charged unsubsidised rates at public hospitals, if they are admitted as suspected COVID-19 patients within 14 days of returning. These people will also not be able to claim from their MediShield Life or Integrated Shield Plans for these treatments at both public and private hospitals.

Since 7 August 2020, some travellers leaving Singapore will be able to tap on regular healthcare financing (government subsidies, MediShield Life and integrated shield plans) for their inpatient medical bills, should they have COVID-19 symptoms within 14 days of their return. These travellers refer to Singaporeans, PRs and long-term pass holders who are travelling abroad under permitted travel arrangements, such as bilateral travel arrangements with Malaysia and China.

- Foreigners

All inbound foreigners (non-Singaporeans, non-PRs) entering Singapore will have to pay unsubsidised rates for inpatient stay at public hospitals, bearing the full cost. This includes tests for COVID-19, SHN at a dedicated facility and medical expenses should they be infected with COVID-19.

Start managing and saving money like a pro with SingSaver’s weekly financial roundups! We dole out easy-to-follow money-saving tips, the latest financial trends and the hottest promotions every week, right into your inbox. This is one mailer you don’t want to miss.

Sign up today to receive our exclusive free investing guide for beginners!

Why you need additional insurance coverage for COVID-19

While the Singapore government does provide some coverage for COVID-19 patients in terms of testing fees and medical bills, insurance plans can go one step further and beef up your protection needs.

| Testing fee | Only sometimes |

|

| Hospitalisation | ||

| COVID-19 outpatient & inpatient medical expenses | ||

| COVID-19 Death & TPD coverage | ||

| Coverage for other infectious diseases (i.e. Dengue fever, Zika, Hand, Food and Mouth Disease) | ||

| Daily hospital cash | ||

| Worldwide coverage | ||

Here's a look at what insurance plans can offer when it comes to coverage for contacting COVID-19.

Free COVID-19 coverage from insurers

In 2020, in the thick of the rising number of COVID-19 cases in Singapore, at least seven insurers were offering their clients with free COVID-19 coverage that includes special lump sum payouts and more. However, we’re now left with two insurance companies offering free COVID-19 coverage:

| Insurance Provider | Coverage | Eligibility | Validity |

| AIA | S$1,000 (lump-sum) Hospitalisation income S$25,000 Death benefit |

Singapore Resident* with a valid NRIC/FIN. Must have an inforce Life Insurance or Accident & Health Insurance policy that has been issued on or before 31 July 2020. | Up till 31 December 2021 or 30 days after the DORSCON level has officially stepped down to green (whichever is earlier) |

| Etiqa | S$100 per day Hospitalisation Benefit (for stable condition, capped at S$1,000) S$200 per day Intensive Care Unit (ICU) Benefit (capped at S$1,000) S$50,000 Death Benefit |

Must have an inforce life protection or insurance savings plans with Etiqa issued/ reinstated before 13 February 2020 | |

AIA: Free Additional Insurance Cover Against COVID-19

AIA is providing existing customers with free additional insurance cover against COVID-19. All eligible customers will automatically benefit from this free additional insurance cover with immediate effect with no action or additional purchase required.

These guaranteed benefits can be received up till 31 December 2021 or 30 days after the Disease Outbreak Response System Condition (DORSCON) level has officially stepped down to green – whichever is earlier.

Full details here.

Etiqa: Financial Assistance Benefit

Etiqa Insurance Singapore has introduced Financial Assistance Benefit to those insured with their life insurance policies in light of the COVID-19 outbreak. You will be eligible for this benefit if you have an existing life protection and insurance savings plans with Etiqa.

This applies to both private and public hospitals in and outside Singapore as long as the hospital is able to provide proof of hospitalisation due to COVID-19.

Full details here.

Personal accident plans covering COVID-19

If you’re looking for plans that provide coverage in the event that you or your loved one contacts COVID-19, here are the personal accident plans you can consider.

| Personal Accident Plan Name | COVID-19 Coverage | Personal Accident Coverage | Other Benefits | Premium |

| Income PA Assurance | S$10,000 death benefit S$100 daily hospitalisation income (up to 30 days) |

S$100,000 for accidental death or TPD S$2,000 in medical expenses S$300 daily hospitalisation income (up to 365 days) |

S$500 benefit for TCM or chiropractor treatment and S$1,000 for physiotherapy | S$217 |

| Great Eastern Comprehensive Care (Basic) | S$10,000 death benefit | S$100,000 for Accidental Death or TPD S$100 daily hospital cash (up to 365 days) S$100 daily ICU cash (up to 30 days) in addition to hospital cash benefit |

Enjoy 6 video-consultations with Doctor Anywhere (transferable to family & friends) | S$264 |

Travel insurance plans covering COVID-19

If you’re one of the rare few that are squeezing your way onto a flight, here are the travel insurance plans that specially offer coverage for COVID-19. If you're not heading out of Singapore, here are some ideas for what you can do with your travel fund instead, or how you can spend your S$100 SingapoRediscover vouchers.

For outbound travellers:

| COVID-19 Coverage | Travel Insurance Coverage | Things to note | |

| Income Travel Insurance | Up to US$100,000 COVID-19 related hospitalisation expenses overseas Up to US$100,000 COVID-19 medical evacuation or repatriation |

Up to S$250,000 overseas medical expenses S$5,000 trip cancellation S$500 trip postponement |

Only available for single-trip (not annual) plans purchased after 26 November 2020 and coverage is available for the first 90 days of each trip COVID-19 coverage excludes high risk countries (deemed as high risk by the World Health Organisation at the time of purchase) |

| Travel Insurance by Travel Guard® on singaporeair.com (by AIG) | One-way trips: Benefit for travel cancellation and postponement available Return trips: - Up to S$350,000 COVID-19 medical evacuation or repatriation - Up to S$150 per day quarantine allowance (up to 14 days) if you test positive for COVID-19 and are unexpectedly placed into mandatory Quarantine outside your country of residence |

Up to S$1 million overseas medical expenses Up to S$7,000 trip cancellation and travel postponement |

Exclusively designed for Singapore Airlines passengers, this can be to your itinerary when making your flight booking on singaporeair.com |

| STARR Cruise To Nowhere Insurance | Up to S$100,000 coverage for overseas COVID-19-related medical expenses Up to S$1,000 coverage for trip cancellations or curtailments due to COVID-19 |

Up to S$1 million in medical expenses coverage, including inpatient and outpatient treatments Up to S$500,000 in personal accident benefit, covering 18 different events of disablement and accidental death 24 hours Global Emergency Assistance Services to connect you with medical treatment and transportation |

Starts from S$12 per day All trips must depart from and return to Singapore |

Travel insurance plans that offer coverage for COVID-19 are now more crucial than ever, providing not just financial coverage but also peace of mind. Despite our best efforts to rein in the virus, a spike in cases remains possible and any overseas plans such as going on a cruise could easily be delayed or scrapped entirely in very short notice.

For inbound travellers:

COVID-19 travel insurance is a mandatory requirement for incoming travellers that apply for an air travel pass from 31 January 2021.

There are just three providers offering coverage curated for foreigners arriving in Singapore, with premiums starting from just S$5.35 with GST. These plans provide at least S$30,000 coverage for COVID-19 medical treatment and hospitalisation costs, a figure recommended by the MOH based on COVID-19 bill sizes at private hospitals. These plans can be purchased directly from the insurers’ website.

- AIG Asia Pacific Insurance — Singapore Travel Assist

- Chubb Insurance Singapore — SG Travel Insured

- HL Assurance — ChangiAssure Covid Insurance

Feel free to reach out to SingSaver Insurance Brokers Pte. Ltd. at insurance_enquiry@singsaver.com.sg or call +65 31382648 if you have any enquiries on coverage related to personal accident plans.

Start managing and saving money like a pro with SingSaver’s weekly financial roundups! We dole out easy-to-follow money-saving tips, the latest financial trends and the hottest promotions every week, right into your inbox. This is one mailer you don’t want to miss.

Sign up today to receive our exclusive free investing guide for beginners!

Read these next:

COVID-19 Tests In Singapore: Its Cost And Where To Go

Insurers Now Cover Allergic Reactions From COVID-19 Vaccination

Best Personal Accident Insurance Plans In Singapore (2021)

Infectious Diseases Insurance (COVID-19, Dengue and Zika): Best Plans to Protect Yourself

How Different Will Travel Be Post COVID-19?

Read all our articles related to COVID-19 here.

Similar articles

Singapore Border Category Restrictions By Country Explained

COVID-19 Tests In Singapore: Its Cost And Where To Go

Singapore – Hong Kong Travel Bubble To Resume: 9 Questions, Answered

Singapore Relaxes SHN Requirements And Eases Border Restrictions: All You Need To Know

Phase 3 In Singapore: What Can You Expect?

What Happens if You Catch COVID-19 Overseas on a Holiday?

Is Travel Insurance With COVID-19 Coverage Still Necessary?

5 Ways to Cope With Financial Setbacks Hitting Singaporeans Hard Amid COVID-19