Opinions expressed reflect the view of the writer (this is his story).

American Express offers two different KrisFlyer cobrand cards in Singapore – the AMEX Singapore Airlines KrisFlyer Credit Card and the AMEX Singapore Airlines KrisFlyer Ascend Credit Card. This can be confusing to some first-timers to the miles and points game: What’s the difference between the cards? What are the pros and cons of each?

In this post, I’m going to break down the similarities and differences between the two cards so you can decide which one is right for you.

What do they have in common?

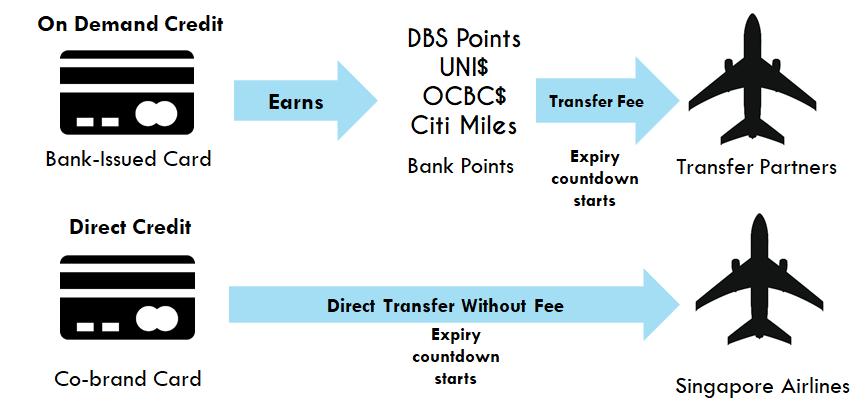

Both the AMEX Singapore Airlines KrisFlyer Credit Card and the AMEX Singapore Airlines KrisFlyer Ascend Credit Card have direct crediting agreements with Singapore Airlines. This means that whatever miles you earn from your spending are credited directly into your KrisFlyer account as soon as transactions post, with no transfer fees.

Contrast this with credit cards issued by banks like DBS and UOB, where you need to manually trigger the crediting process and pay a transfer fee that’s typically around $25.

Direct crediting is great if you want to avoid transfer fees, but do note that it also means the 3-year KrisFlyer expiry countdown starts as soon as you earn your miles. In contrast, earning points with a bank-issued card gives you the option to delay your transfer until you’re ready to use your miles, thereby extending their useful life.

How are they different?

The AMEX KrisFlyer Credit Card and the AMEX KrisFlyer Ascend differ in terms of their income requirement, annual fee, sign-up bonus, earning rates on local spending, as well as additional card benefits.

Here’s a summary table highlighting the differences:

| KrisFlyer Credit Card | KrisFlyer Ascend | |

| Income Req. | Card application is subjected to customers meeting the regulatory minimum income requirement and internal assessment | Card application is subjected to customers meeting the regulatory minimum income requirement and internal assessment |

| Annual Fee | S$178.20 (waived for First Year) | S$340.20 |

| Sign up bonus | Spend $3,000 in the first 3 months to get 7,500 bonus miles, spend a further $3,000 in months 4-6 to get another 7,500 bonus miles Earn 5,000 bonus miles on your first spend of any amount |

Spend $6,000 in the first 3 months to get 15,000 bonus miles, spend a further $6,000 in months 4-6 to get another 15,000 bonus miles Earn 5,000 bonus miles on your first spend of any amount |

| Local Spending | 1.1 mpd (miles per dollar) | 1.2 mpd |

| Overseas Spending | 2.0 mpd in June/December | |

| Specialised Spending | 2.0 mpd on Singapore Airlines/ Silk Air tickets and KrisShop 3.1 mpd on the first $200 per month spent with Grab & 500 miles with first spend |

|

| Additional Benefits |

Receive S$150 Cashback for use on your next purchase on singaporeair.com when you spend S$12,000 on eligible purchases by 30 June 2019 |

|

That’s a lot to take in! Let’s examine these aspects one by one and see how it affects your valuation of the card.

Annual Fee

The AMEX KrisFlyer Credit Card has a lower annual fee (S$178.20) than the AMEX KrisFlyer Ascend (S$340.20) and comes with a first-year fee waiver. The Ascend's higher annual fee reflects its additional benefits, such as four lounge vouchers and a complimentary night at selected Hilton properties.

Sign Up Bonus

Sign up bonuses are a real highlight for the KrisFlyer cobrand cards. The AMEX KrisFlyer Credit Card offers a total of 26,600 miles when you spend $6,000 in the first 6 months. This is broken down into:

- 5,000 bonus miles on your first spend (only for first-time cobrand cardholders)

- 7,500 bonus miles for spending $3,000 within 3 months of approval, and a further 7,500 bonus miles for spending $3,000 in months 4-6

- 6,600 base miles for spending $6,000 @ 1.1 mpd

The AMEX Singapore Airlines KrisFlyer Ascend Credit Card offers a total of 49,400 miles when you spend $12,000 in the first 6 months.

This is broken down into:

- 5,000 bonus miles on your first spend (only for first-time cobrand cardholders)

- 15,000 bonus miles for spending $6,000 within 3 months of approval, and a further 15,000 bonus miles for spending $6,000 in months 4-6

- 14,400 base miles for spending $12,000 @ 1.2 mpd

On a miles-to-spending ratio, the AMEX Singapore Airlines KrisFlyer Credit Card comes out on top. However, in terms of absolute miles earned, the AMEX Singapore Airlines KrisFlyer Ascend Credit Card is a better choice. 49,400 miles is sufficient to get you and your partner round trip tickets to Bali, with plenty to spare. Alternatively, for an additional 600 miles, you could fly round trip to Tokyo or Seoul.

Earning Rates

There's not a lot to separate these two cards when it comes to earning rates, except that the AMEX KrisFlyer Ascend earns 8% more miles (1.2 vs 1.1) than the KrisFlyer Credit Card card on general spending.

Both cards earn 2.0 mpd on overseas general spending, but that's only for June or December. You'll earn 2.0 mpd on Singapore Airlines/Silk Air tickets (but note that you could use the DBS WWMC for 4 mpd on the first $2K of online spending per month, or the DBS Altitude for 3 mpd on the first $5K of air ticket spending per month), or purchases on KrisShop.

This is a decent card to use for Grab, with 3.1 and 3.2 mpd for the AMEX Singapore Airlines KrisFlyer Credit Card and AMEX Singapore Airlines KrisFlyer Ascend Credit Card respectively (you’d earn 4.0 mpd with the Citi Rewards card though).

Card Benefits

Here's what really separates the two cobrand cards. The AMEX Singapore Airlines KrisFlyer Credit Card is a pretty bare-bones card (probably why they're willing to waive the first year annual fee). The only benefit to speak of is that you get a S$150 cashback on singaporeair.com when you spend S$12,000 by 30 June 2019.

The AMEX Singapore Airlines KrisFlyer Ascend Credit Card, on the other hand, packs quite a punch in this area. Here's what you get with the annual fee:

- Four complimentary passes each year to any participating SATS Premier Lounge in Singapore and Plaza Premium Lounges around the world

- A complimentary night stay each year at one of over 110 Hilton Properties in Asia Pacific

- Hilton Silver status

- A double KrisFlyer miles accrual voucher (capped at 5,000 miles) when you spend S$15,000 or more on singaporeair.com by 30 June 2019

- Fast track to KrisFlyer Elite Gold when you spend S$15,000 or more on singaporeair.com within 12 months of card approval

If you just want a bare-bones card with an easier-to-hit signup bonus, go for the AMEX Singapore Airlines KrisFlyer Credit Card. If you're eyeing more benefits and a higher signup bonus, the AMEX Singapore Airlines KrisFlyer Ascend Credit Card might be better for you.

SingSaver Exclusive Offer

What's more, apply through SingSaver and receive additional bonus 4,500 miles or 6,500 miles when you hit the minimum spend for the first 3 months on the AMEX Krisflyer and AMEX Krisflyer Ascend respectively!

These bonus miles will not be awarded if you apply through the bank's own website.

Find out more about both cards below:

Read these next:

Amex, Visa, or Mastercard: Which is the Best For Travel?

Credit Card Signup Bonuses: How to Maximise Miles with Big Ticket Spending

Everything You Need to Know About Air Miles Credit Card Fees in Singapore

6 Credit Cards Which Give Free Access to Airport Lounges

Air Miles Cards: 8 Questions To Help You Choose the Right Card

By Aaron Wong

Aaron started The MileLion to help people travel better for less and impress “chiobu”. He was 50% successful. This is his story.

Similar articles

6 Ways to Turbocharge Your Travel Hacking Game

Should You Use the KrisFlyer UOB Debit Card to Earn Miles?

3 Air Miles Credit Cards With the Best Bonus Miles Offers

3 Key News Updates For AMEX Singapore Airlines KrisFlyer Credit Cardmembers To Know About

AMEX Singapore Airlines KrisFlyer Ascend Credit Card Review (2024): A Hint Of Luxury For Miles-Chasers

Get a Free Round-trip to Bali on Singapore Airlines with American Express

AMEX Singapore Airlines KrisFlyer Credit Card Review (2024): Entry-Level Card For All Miles Beginners

Credit Card Signup Bonuses: How to Maximise Miles with Big Ticket Spending