DBS Travel Insurance by Chubb | 2025 Review

Updated: 28 Aug 2025

Written bySingSaver Team

Team

The information on this page is for educational and informational purposes only and should not be considered financial or investment advice. While we review and compare financial products to help you find the best options, we do not provide personalised recommendations or investment advisory services. Always do your own research or consult a licensed financial professional before making any financial decisions.

DBS TravellerShield Plus stands as one of the best travel insurance plans on the market, with the uncanny ability to match almost any type of itinerary. Unfortunately, this plan stumbles when addressing the needs of those with pre-existing conditions.

Underwritten by Chubb Insurance Singapore Limited, DBS TravellerShield Plus makes good use of synergies in the insurer’s well-established network of insurance products. The result is an attractive combination of high coverage, a wide range of benefits, and competitive premiums. Another benefit of DBS travel insurance is its accessibility to DBS and POSB customers, providing a convenient way to quickly secure a travel plan before your vacation.

Comparison of TravellerShield Plus plans

|

Plan Types and Benefits |

Complimentary Plan |

Classic |

Premier |

Platinum |

|

Policy Cover |

N/A |

Single trip, annual multi-trip |

Single trip, annual multi-trip |

Single trip, annual multi-trip |

|

COVID-19 Benefits |

Included |

Included |

Included |

Included |

|

Cruise-to-Nowhere |

N/A |

Included |

Included |

Included |

|

Extreme Sports & Sporting Activities |

Covered with exceptions |

Not covered |

Covered with exceptions |

Covered with exceptions |

|

Pre-Existing Conditions |

Not covered |

Optional add-on available |

Optional add-on available |

Optional add-on available |

|

Overseas Medical Expenses (includes COVID-19 cover) |

S$5,000 |

S$300,000 S$100,000 (Pre-existing conditions) |

S$500,000 S$125,000 (Pre-existing conditions) |

S$1,000,000 S$150,000 (Pre-existing conditions) |

|

Continuation of Medical Treatment in Singapore |

Not covered |

S$25,000 |

S$50,000 |

S$75,000 |

|

Hospital Confinement Benefit |

Overseas: S$100/day (Up to 5 days) |

Overseas: S$200/day (up to S$10,000) Overseas (ICU): S$400/day (up to S$4,000) In Singapore: S$100/day (up to S$500) |

Overseas: S$200/day (up to S$30,000) Overseas (ICU): S$400/day (up to S$5,600) In Singapore: S$100/day (up to S$1,500) |

Overseas: S$200/day (up to S$50,000) Overseas (ICU): S$400/day (up to S$8,000) In Singapore: S$100/day (up to S$2,000) |

|

Emergency Evacuation and Repatriation |

N/A |

Emergency medical evacuation: S$1,000,000 Repatriation of remains: S$50,000 |

Emergency medical evacuation: S$1,000,000 Repatriation of remains: S$100,000 |

Emergency medical evacuation: S$1,000,000 Repatriation of remains: S$50,000 |

|

Accidental Death and Disablement |

S$1,000,000 (Public Conveyance) S$50,000 (Elsewhere) |

S$150,000 |

S$200,000 |

S$500,000 |

|

Public Conveyance Double Cover |

N/A |

S$300,000 |

S$400,000 |

S$1,000,000 |

|

Travel Cancellation |

S$500 (if cancelled due to COVID-19) |

S$5,000 |

S$10,000 |

S$15,000 |

|

Travel Curtailment |

N/A |

S$5,000 |

S$10,000 |

S$15,000 |

|

Loss or Damage to Baggage |

S$1,000 |

S$3,000 |

S$5,000 |

S$8,000 |

|

Home Contents Cover |

N/A |

S$5,000 |

S$20,000 |

S$20,000 |

|

Terrorism Extension |

Covered |

Covered |

Covered |

Covered |

|

Automatic Policy Extension |

N/A |

Covered |

Covered |

Covered |

|

Loss of Frequent Flyer Miles/Hotel Loyalty Points |

Not Covered |

Not Covered |

S$5,000 |

S$7,500 |

*Complimentary plan coverage specified above is issued to DBS Treasures Black Elite cardholders

Ever wondered how complimentary travel insurance measures up to a paid product? As you can see, the complimentary coverage issued to DBS Treasures Black Elite cardholders lacks in several areas. The most glaring omissions are for Emergency Evacuation and Repatriation and pre-existing conditions. Like for paid Classic plans, there’s also no cover available for Rental Vehicle Excess. Our take? If you value peace of mind, it’s best to get a paid travel plan before you fly — especially if you have pre-existing conditions.

Comparing prices across TravellerShield Plus plans

|

Complimentary |

Classic |

Premier |

Platinum |

|

|

1 Adult (7 days in Thailand) |

N/A |

S$30 (Pre-ex add-on: S$47) |

S$40 (Pre-ex add-on: S$57) |

S$50 (Pre-ex add-on: S$67) |

|

1 Adult (7 days in Japan) |

N/A |

S$35 (Pre-ex add-on: S$45) |

S$45 (Pre-ex add-on: S$55) |

S$55.50 (Pre-ex add-on: S$65.50) |

|

1 Adult (7 days in the United Kingdom) |

N/A |

S$65 (Pre-ex add-on: S$75) |

S$70 (Pre-ex add-on: S$85) |

S$75.50 (Pre-ex add-on: S$90.50) |

*Based on a single adult under 70 years of age on a single-trip plan.

Although the Pre-Existing Medical Condition Benefit add-on from DBS TravellerShield Plus doesn’t come cheap, it’s worth paying for if you have chronic health issues and wish to ensure that you have adequate coverage. Note that this optional benefit is not available via DBS’s complimentary travel plan.

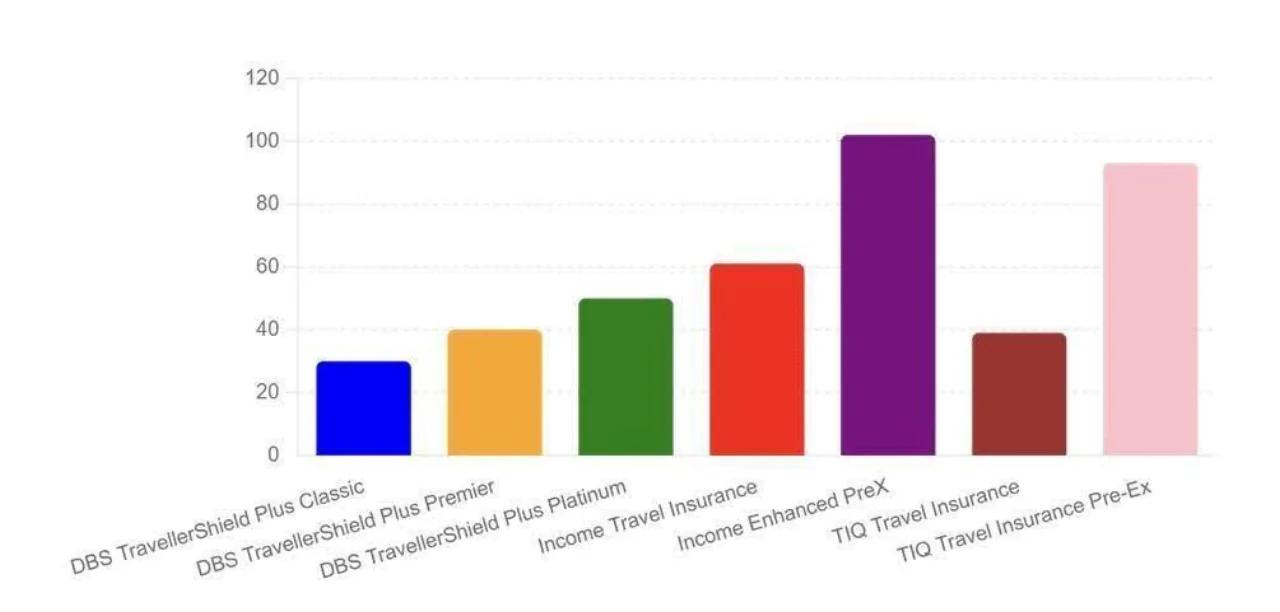

TravellerShield Plus vs. other travel insurance providers

|

Traveller Shield Plus Complimentary |

Traveller Shield Plus Classic |

Traveller Shield Plus Premier |

Traveller Shield Plus Platinum |

Income Travel Insurance (Deluxe) |

Income Enhanced PreX (Superior) |

Tiq Travel Insurance |

Tiq Travel Insurance Pre-Ex (Savvy) |

|

|

Price |

N/A |

S$30 |

S$40 |

S$50 |

S$45 |

S$55 |

S$35 |

S$47 |

|

Overseas Medical Expenses |

S$5,000 |

S$300,000 |

S$500,000 |

S$1,000,000 |

S$500,000 |

S$500,000 |

S$200,000 |

S$125,000 |

|

Emergency Medical Evacuation |

N/A |

S$1,000,000 |

S$1,000,000 |

S$1,000,000 |

Unlimited |

Unlimited |

S$1,000,000 (Combined limit) |

S$200,000 (Combined limit) |

|

Trip Cancellation |

S$500 (If cancelled due to COVID-19) |

S$5,000 |

S$10,000 |

S$15,000 |

S$10,000 |

S$10,000 |

S$5,000 |

S$5,000 |

|

Travel Delay |

S$400 (For flight delays) |

S$100 every 6 hours (Max. S$1,200) |

S$100 every 6 hours (Max. S$1,600) |

S$100 every 6 hours (Max. S$2,000) |

S$100 every 6 hours (Max. S$1,500) |

S$100 every 6 hours (Max. S$1,500) |

S$50 every 3 hours (Max. S$300) |

S$50 every 3 hours (Max. S$300) |

|

Baggage Loss |

S$1,000 |

S$1,000 |

S$3,000 |

S$5,000 |

S$5,000 |

S$5,000 |

S$2,000 |

S$2,000 |

|

Baggage Delay |

S$400 |

$200 every 6 hours (Max. $1,200) |

$200 every 6 hours (Max. $1,600) |

$200 every 6 hours (Max. $2,000) |

$200 every 6 hours (Max. $1,200) |

$200 every 6 hours (Max. $1,200) |

S$100 every 6 hours (Max. $200) |

S$100 every 6 hours (Max. $200) |

|

COVID-19 coverage |

S$5,000 |

S$300,000 |

S$500,000 (covered under Overseas Medical Expenses) |

S$1,000,000 (covered under Overseas Medical Expenses) |

S$500,000 |

S$500,000 |

S$500,000 |

S$500,000 |

|

Pre-existing conditions coverage |

Not covered |

Optional add-on available |

Optional add-on available |

Optional add-on available |

See Enhanced PreX plan |

Covered |

Pre-ex plans available |

Covered |

Income and Tiq are 2 other notable travel insurance providers that those with pre-existing conditions can look to. Both providers offer these specialised plans in 3 tiers, so that travellers of every budget level can ensure they have the coverage they need. Income and Tiq both also offer optional COVID-19 add-ons, which protect against Travel Inconveniences and Overseas Medical Expenses. Notably, Tiq also offers a lump sum payout ranging from S$100 to S$300 if you are hospitalised in Singapore.

Comparing coverage, pricing and protection

-

Overseas Medical and Hospitalisation Benefits: DBS TravellerShield Plus offers up to S$1,000,000 for coverage of overseas medical expenses. This protects you in the event that you require urgent medical care while on your trip. Additionally, you also get hospital confinement benefits on a per-day basis, which helps soften the financial blow should you require hospitalisation. This coverage also extends to hospitalisation in Singapore, though the benefits for local care are much lower.

-

Emergency Evacuation and Personal Accident Benefits: If you suffer a serious illness or injury, and are assessed by a doctor designated by Chubb Assistance to require necessary medical treatment that is not available at your location, you may be medically evacuated to another location for urgent care.

-

Travel Inconvenience: All providers offer trip cancellation and delay coverage, but the extent of coverage varies. DBS TravellerShield Plus Classic might be suitable for shorter trips with lower costs, while other plans could be a better fit for longer or pricier ventures.

-

Baggage and Delay: Coverage for lost or delayed baggage is generally on par compared to other providers. TravellerShield Plus Platinum, Income Deluxe and Income Enhanced PreX Superior plans offer the most generous limits, particularly for baggage loss.

-

COVID-19 Coverage: DBS plans include COVID-19 coverage, where it is parked under Overseas Medical Expenses. Income has enhanced COVID-19 coverage from April 2023 and includes it at no additional charge. Finally, COVID-19 coverage is offered by TIQ as an optional add-on.

-

Pricing: When it comes to cost, TravellerShield Plus plans can be a little pricey compared to travel plans from other providers. However, TravellerShield Plus makes up for it with coverage that is quite comprehensive.

-

Pre-Existing Conditions: If you have any chronic illnesses, be sure to review DBS's policy wording on their Pre-Existing Medical Condition Benefit add-on to determine if coverage is adequate.

List of DBS travel insurance exclusions

We’ve highlighted some general exclusions in DBS TravellerShield Plus. Be sure to check the policy wording for the full list of exclusions:

-

Mental or nervous disorders

-

Self-inflicted injury or suicide

-

Nuclear, Chemical or Biological Terrorism

-

Complications related to pregnancy, childbirth, or miscarriage (except accidental miscarriage due to Accidental Injury)

-

Activities while under the influence of drugs or alcohol

-

Professional competitions or sports where you receive remunerations, sponsorships or financial rewards

-

Extreme Sports and Sporting Activities, though exceptions apply

-

Travelling against the advice of a doctor, or for the purposes of seeking medical attention

-

Loss or damages with respect to Cuba (this policy does not cover travel to Cuba)

-

War, acts of war, invasions and rebellions

Pros and cons of DBS travel insurance

Pros

High coverage for Overseas Medical Expenses, Travel Inconveniences and Personal Accidents with Public Conveyance Double Cover

S$1,000,000 Emergency Medical Evacuation cover for all plans

Home contents cover under Home Guard available for all plans

Cons

Add-on for pre-existing conditions can be costly

Loss of Frequent Flyer Miles/Hotel Loyalty Points cover only available for Premier and Platinum plans

Public Conveyance Double Cover not available for those aged 70 years and above

If coverage variety matters to you, DBS TravellerShield Plus would make a great choice on account of its flexibility.

Its wide-ranging scope of coverage encompasses cruise-to-nowhere, accidental emergency dental and rental car excess benefits, making this a plan that fits snugly into almost any type of travel itinerary.

One sticking point, though, is the high cost of pre-existing conditions coverage, as well as low coverage levels offered, compared to the plan’s regular benefits.

Besides that, there’s plenty to like here, and travellers shouldn’t overlook DBS TravellerShield Plus when looking for a suitable travel insurance plan.

A closer look at DBS travel insurance benefits

Overseas medical and hospitalisation

DBS TravellerShield Plus offers up to S$1,000,000 for coverage of overseas medical expenses. Additionally, TravellerShield Plus also covers you for follow-up medical treatment in Singapore, which will help you preserve your Medisave funds for later use. Note that this benefit is excluded from the complimentary version of the TravellerShield Plus plan.

DBS TravellerShield Plus also offers hospital confinement benefits, providing an additional buffer for you and your family to cope with extra expenses. While overseas, you will be entitled to cash benefits of S$200 per day, which doubles to S$400 per day if you are warded in the Intensive Care Unit. If you are hospitalised in Singapore, you will receive S$100 per day instead.

Emergency evacuation and personal accident

Another area where DBS TravellerShield Plus shines is their Emergency Medical Evacuation coverage. Every plan, from the entry-level Classic plan to their top-tier Platinum plan, offers S$1,000,000 for Emergency Medical Evacuation. In cases where death or permanent disablement occurs, your beneficiary will receive a lump-sum payout of either S$150,00, S$300,000 or S$500,000 — depending on which plan you have. For individuals aged 70 years old and above, this payout is lowered to S$50,000, S$100,000 or S$150,000 respectively. For children, this benefit is again lowered to S$25,000, S$50,000 and S$100,000.

Travel inconvenience

With DBS TravellerShield Plus, you'll receive solid protection against Travel Inconvenience no matter which plan you choose. Here's a non-exhaustive list of Travel Inconvenience benefits you'll receive:

-

Travel cancellation

-

Travel postponement

-

Travel curtailment

-

Travel disruption

-

Travel delay

-

Loss of advance payment due to insolvency of travel agent

-

Flight diversions

-

Flight overbooking

Finally, DBS has updated their TravellerShield Plus plans so that Premier and Platinum customers are also covered for loss of frequent flyer miles and hotel loyalty points. This means that if you experience a serious illness or involuntarily lose your job, DBS will cover you for up to S$5,000 or S$7,500 — depending on whether you possess a Premier or Platinum plan.

Adventure

Not everybody travels to unwind; in fact, some do it to chase an adrenaline rush. If you're travelling to take part in Extreme Sports and Sporting Activities, be aware that not every activity is covered by TravellerShield Plus.

|

Covered |

Not Covered |

|

Ultra-marathons, biathlons and triathlons |

Racing events |

|

Trekking below 3,000 metres |

Trekking above 3,000 metres |

|

Scuba diving with a PADI certification or similar recognised accreditation |

Professional sporting events where you receive rewards in the form of remuneration, sponsorship or financial gains |

|

White water rafting from Grades I to III |

White water rafting from Grades IV to V |

|

Off-piste skiing |

|

|

Mountaineering |

How to get DBS complimentary travel insurance

Want to snag a complimentary TravellerShield Plus plan? Here's how:

-

DBS Treasures Black Elite Card: If you are an existing cardholder, know that you won't be seeing more Black Elite cardholders popping up anytime soon. This is because applications for this credit card have been suspended by DBS since 1 January 2023. However, existing members can still make use of their card benefits, which include a complimentary TravellerShield Plus plan.

-

DBS Insignia Visa Infinite Card: Even more exclusive than the DBS Treasures Black Elite Card, the Insignia Visa Infinite Card is an invitation-only credit card. Charging your airfare to your card will net you a complimentary TravellerShield Plus plan.

-

DBS Travel & Leisure Marketplace: If you book your flight or hotel stays through the DBS Travel Marketplace, you'll see your free TravellerShield Plus plan activated during checkout.

DBS Travel Insurance Claim

DBS has a handy checklist for policyholders to determine what documents are needed to file a claim. Here are the actions you need to take to submit your claim:

-

Step 1: Determine what benefits you would like to submit a claim for.

-

Step 2: Refer to DBS's guide on how to submit your DBS TravellerShield Plus claim to know what documents you'll need for your claim. For instance, a medical report, doctor's invoice and receipts would be required to submit a claim for Overseas Medical Expenses.

-

Step 3: Gather all necessary documents and submit your claim online

Your claims will be processed within 7 working days.

You may choose to receive approved claim payouts via FAST or PayNow.

Here’s how to get in touch with Chubb:

-

Emergency Hotline: +65 6322 2132 (Available 24 hours)

-

Claims Hotline: +65 6398 8797 (Mondays to Fridays, 9.00am to 5.00pm, excluding Public Holidays)

Should you get DBS Travel Insurance?

If you're going on a weekend trip to somewhere nearby, such as Bali or Bangkok, a complimentary DBS TravellerShield Plus plan is better than having no plan at all. But if you're eyeing a vacation in Spain or Japan, shelling out some extra cash for a Premier plan might help you strike the balance between cost savings and adequate protection. For individuals with chronic illnesses, do note that DBS's optional add-on for pre-existing conditions only covers you for up to 30 days. Something to consider if you're finally taking up that long sabbatical.

Relevant articles

Annual vs Single Trip Travel Insurance: Which Policy Saves You More Money and Hassle?

Planning your next holiday? Don't forget to consider your travel insurance options. As a Singaporean traveller, you're faced with a crucial decision: annual or single trip travel insurance. Both choices offer unique benefits, but which one truly saves you more money and reduces hassle? Let's explore the key differences between these two types of policies so that you can make an informed decision that ensures you're covered without breaking the bank.

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.