Savings & Credit Cards

Learn all the ins and outs of the best and most effective credit cards for each situation

Featured Articles

Fixed Deposits

Last Updated Jan 8, 2025

Savings Accounts

Last Updated Nov 2, 2024

Featured Articles

Last Updated Jan 8, 2025

Last Updated Nov 2, 2024

Popular articles

All articles

Best Bank Promotions and Offers in Singapore

Last updated

May 22, 2025

How to Earn up to 4.85% p.a. on Your Foreign Currency Funds

Last updated

Nov 28, 2024

Want Free Dyson Products? Here’s How to Get Yours!

Last updated

Nov 27, 2024

Explainer: The big changes to the AMEX Singapore Airlines Credit Cards from November 2024

Last updated

Nov 8, 2024

Mari Credit Card Review | Earn Up to 5% Unlimited Cashback with Mari Credit Card

Last updated

Oct 10, 2024

A Smart Homeowner's Guide: Unlock Exclusive Perks with COURTS DCS Mastercard

Last updated

Sep 30, 2024

Avoid This Top Financial Mistake Singaporeans Make to Achieve Financial Independence

Last updated

Sep 25, 2024

Join the SingSaver Mega Miles Giveaway with heymax

Last updated

Sep 24, 2024

Best iPad Credit Card 2024 Guide: Cashback & Miles Options Galore

Last updated

Sep 15, 2024

Apple iPhone 15 Price and Discounts 2024

Last updated

Sep 15, 2024

DBS Salary & Spend: Add an Easy S$500 to Your Account

Last updated

Sep 13, 2024

Should You Upgrade to iPhone 16, and Best Credit Cards to Use

Last updated

Sep 10, 2024

How To Get Airline And Hotel Elite Status Through Credit Cards

Last updated

Sep 9, 2024

SingSaver Credit Card Flash Deal: Get S$700 Vouchers With Citi, HSBC or SCB!

Last updated

Aug 19, 2024

How To Maximise Fuel Savings With the Right Credit Card Promotions

Last updated

Jul 29, 2024

Enjoy over S$8,850 Savings with The AMEX Singapore Airlines Business Credit Card

Last updated

Jul 18, 2024

Taking Stock: How My Credit Card Strategy Has Changed Since The Start Of 2024

Last updated

Jul 8, 2024

Best Credit Card Hotel Promotions and Discounts 2024

Last updated

Jun 18, 2024

Citi Prestige Card Review (2024): Premium Rewards For Gold-Class Travel and Lifestyle

Last updated

Jun 7, 2024

Guide to Credit Card Overseas Charges and Transaction Fees

Last updated

Jun 6, 2024

Best Credit Cards to Use in Japan

Last updated

Jun 5, 2024

Best Credit Card Flight Promotions and Discounts 2024

Last updated

Jun 5, 2024

How to Maximise Your Credit Card Miles with Airbnb?

Last updated

Jun 5, 2024

6 Pitfalls to Avoid During The June Travel Period

Last updated

Jun 5, 2024

Cash Rebates vs Cashback: What’s The Difference?

Last updated

May 21, 2024

Best Credit Card Strategy Singapore 2024: How to Choose the Best Credit Card for You

Last updated

May 20, 2024

How to Earn Cashback at Hawker Centres With DBS PayLah?

Last updated

May 20, 2024

How to Redeem Your Citibank Cash Back?

Last updated

May 16, 2024

How to Pay Credit Card Bills from Another Bank

Last updated

May 14, 2024

When Can I Apply for a Credit Card?

Last updated

May 13, 2024

How Much Are KrisFlyer Miles Worth?

Last updated

May 10, 2024

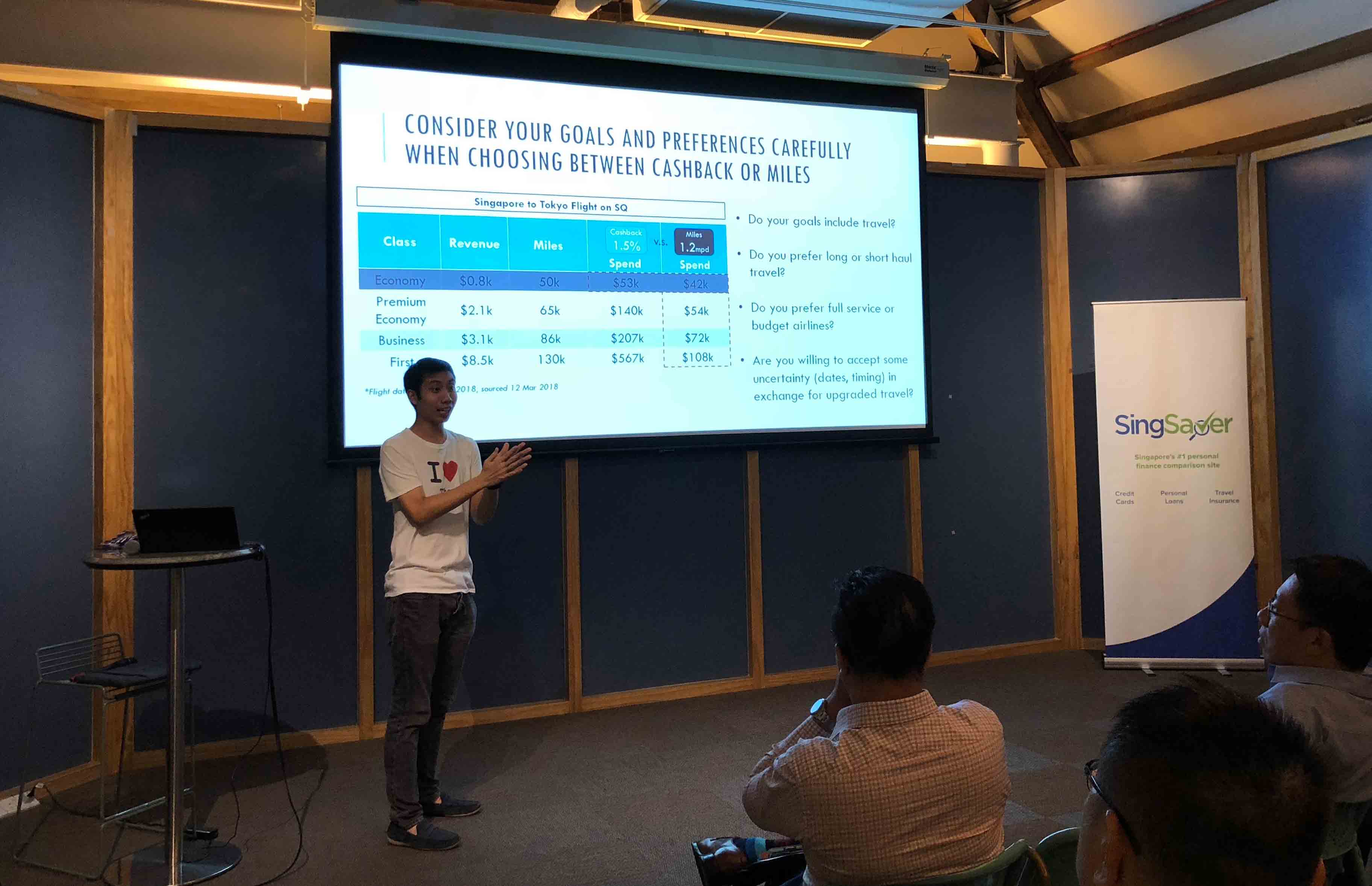

Team Cashback Vs Team Miles: Which Credit Card Side Will You Pick?

Last updated

May 8, 2024

How to Check My Credit Card Application Status?

Last updated

May 6, 2024

How Does Credit Card Interest Work?

Last updated

May 6, 2024

Rookie Miles Mistakes (And How to Avoid Them)

Last updated

May 6, 2024

Singsaver Rewards Upgrade Campaign Credit Card Promotion: Citi and HSBC

Last updated

May 6, 2024

How to Increase Your Credit Card Limit

Last updated

May 2, 2024

How to Apply For a Credit Card in Singapore

Last updated

Apr 17, 2024

Can A Foreigner Open A Bank Account In Singapore?

Last updated

Apr 17, 2024

UOB Visa Signature Credit Card Review (2024): Double the Perks for Local and Overseas Spending

Last updated

Apr 11, 2024

How to Redeem DBS Points to Miles?

Last updated

Apr 8, 2024

Four Money Hacks to Live Your Best Life with The American Express Platinum Credit Card

Last updated

Mar 18, 2024

My Take On The DBS Woman’s World Card and UOB Lady’s Card Devaluations

Last updated

Mar 14, 2024

Amex SIA Business Credit Card: Enjoy High Rewards On Business Spending

Last updated

Mar 12, 2024

How to Redeem UOB Rewards Points

Last updated

Mar 11, 2024

What Are the Different Credit Card Fees and How To Avoid Them?

Last updated

Mar 11, 2024

Transferring and Using Miles for Someone Else

Last updated

Mar 6, 2024

How to Convert Credit Card Points to Miles

Last updated

Mar 5, 2024

Best Credit Cards For And Latest Taobao Promotions

Last updated

Feb 4, 2024

Best Miles Cards in Singapore (2024)

Last updated

Feb 1, 2024

Best Credit Cards For Agoda Promotions

Last updated

Jan 30, 2024

Unlock Fuss-free, Upsized Cashback At Yuu-r Fingertips: PAssion POSB Debit Card

Last updated

Jan 19, 2024

2023 Round-Up of Credit Card Changes That You Should Know About

Last updated

Jan 12, 2024

4 Signs You’re In Need Of A New Savings Account

Last updated

Nov 29, 2023

OCBC INFINITY Cashback Card Review: Your New Gateway To "Infinite" Cashback

Last updated

Nov 29, 2023

MariBank Review: How Does It Compare Against GXS And Trust Bank?

Last updated

Nov 27, 2023

DBS Live Fresh Credit Card Review: Turn Your Everyday Spend Into Effortless Cashback

Last updated

Nov 27, 2023

Which Credit Card Should You Use For Year-End Travel?

Last updated

Nov 24, 2023

Airwallex Review: The Best Corporate Card For SMEs

Last updated

Nov 17, 2023

Credit Card Minimum Payments: Are They A Trap?

Last updated

Nov 9, 2023

Understanding Your Credit Card Limit: What You Need to Know

Last updated

Nov 3, 2023

Mastering Your Finances: How to Pay Your Credit Card Bill on Time?

Last updated

Oct 31, 2023

Building Credit Responsibly With Secured Credit Cards In Singapore

Last updated

Oct 24, 2023

How to Activate Your Credit Card For Overseas Use

Last updated

Oct 18, 2023

Which Supplementary Cards Offer The Best Benefits?

Last updated

Oct 14, 2023

Spring Cleaning Your Credit Cards

Last updated

Oct 4, 2023

Why You Should Own a Credit Card in Singapore: 7 Benefits You Can Enjoy

Last updated

Sep 20, 2023

Citi Ultima Card Review: Best Luxury Card For High Income Earners?

Last updated

Sep 19, 2023

The Best Credit Cards With Free Luggage For You To Acquire

Last updated

Sep 12, 2023

UOB Mighty FX Review 2023: Get FX Ready with More Bang for Your Foreign Bucks

Last updated

Sep 7, 2023

Which Credit Cards Offer The Most Transfer Partners?

Last updated

Sep 4, 2023

Which Banks Pool Credit Card Points?

Last updated

Aug 17, 2023

Best Credit Card to Start Earning Your Revenge Travel Stripes: HSBC TravelOne

Last updated

Jul 21, 2023

CIMB Visa Infinite Card Review (2023): Premium Credit Card with S$0 Annual Fee

Last updated

Jul 17, 2023

CIMB World Mastercard Review (2023): Unlimited 2% Cashback With a Hint of Luxury

Last updated

Jun 26, 2023

American Express Platinum Charge Card Review (2023)

Last updated

Jun 15, 2023

Best Credit Cards For Mobile Wallet Payments

Last updated

Mar 29, 2023

Best Credit Cards For Your Fast Food Cravings & Late Night Supper Runs at McDonald’s

Last updated

Mar 21, 2023

Earn S$1,222 Cashback Annually with the Ultimate Credit Card & Savings Account Combo

Last updated

Mar 16, 2023

Best DCS Card Centre Credit Cards in Singapore (2023)

Last updated

Mar 13, 2023

How To Maximise The Miles Earned On Big Ticket Spending

Last updated

Mar 3, 2023

Beat the GST Hike by Earning up to 7.65% + 2.00%* a Year on your Savings

Last updated

Feb 17, 2023

How To Meet Your Credit Card Minimum Spend Without Overspending

Last updated

Feb 7, 2023

The Only Credit Card Guide You Need in Singapore 2023: Cashback, Miles, Rewards

Last updated

Jan 30, 2023

7 Common Mistakes People Make When Redeeming Miles

Last updated

Jan 13, 2023

Save Money On Daily Essentials With This One Card

Last updated

Jan 3, 2023

Credit Card Spend And Redeem Promotion (2022) -- Christmas Promotions

Last updated

Dec 5, 2022

5 Reasons Why You Should Put Your Trust in Trust Bank’s Savings Account Before 2022 is Over

Last updated

Nov 29, 2022

DBS yuu Card Review: Is There Really A Difference Between The Visa And AMEX Version?

Last updated

Nov 17, 2022

Best Unlimited Cashback Credit Cards in Singapore (2022)

Last updated

Oct 20, 2022

8 Tips to Survive The Great Singapore Sale

Last updated

Sep 20, 2022

Digital Banking Showdown: GXS Bank vs. Trust Bank, and the Future of Traditional Banking

Last updated

Sep 12, 2022

Best Savings Accounts in Singapore to Park Your Money (September 2022)

Last updated

Sep 8, 2022

CIMB StarSaver (Savings) Account Review: No Hoops To Jump Through

Last updated

Sep 8, 2022

13 Best Fixed Deposit From Top Banks In Singapore To Lock In Your Savings (September 2022)

Last updated

Sep 5, 2022

Best Cash Management Accounts In Singapore To Soup Up Your Savings (2022)

Last updated

Sep 5, 2022

Best Rewards Credit Cards In Singapore (2022)

Last updated

Sep 2, 2022

UOB One Card Review (2022): Generous Cashback Card For Grab Users And Dairy Farm Shoppers

Last updated

Sep 1, 2022

Best Grocery Credit Cards In Singapore 2022

Last updated

Sep 1, 2022

OCBC 360 Account Review 2022: Earn Up To 4.05% Interest & The Return Of “Spend” Category

Last updated

Aug 31, 2022

Singapore’s Core Inflation Rises to 4.8% in July: How Will This Affect You?

Last updated

Aug 24, 2022

6 Reasons Why Your First Credit Card Should Be An Unlimited Cashback Card

Last updated

Aug 19, 2022

Do You Think You Belong to The Sandwich Generation: Who are They & Why are They Struggling Today?

Last updated

Aug 15, 2022

Best UOB Credit Cards In Singapore (2022)

Last updated

Aug 12, 2022

8 Ways to Earn More Cashback on Credit Cards, Shopping Apps, and More

Last updated

Aug 10, 2022

7th Lunar Month Superstitions That Can Save You Money

Last updated

Aug 9, 2022

Best Air Miles Credit Cards In Singapore (2022)

Last updated

Aug 5, 2022

Best Maybank Credit Cards in Singapore (2022)

Last updated

Aug 5, 2022

Best Credit Cards To Buy Tickets For Dota 2’s The International 2022

Last updated

Aug 5, 2022

4 Reasons Why DBS Multiplier Is A Competitive Savings Account

Last updated

Aug 2, 2022

DBS Multiplier Is The Most Pandemic-proof Savings Account Yet. Here’s Why.

Last updated

Aug 2, 2022

Here’s How to Build An Emergency Fund On A Tight Budget

Last updated

Jul 29, 2022

8 Ways to Stretch Your Budget In A One-Income Household

Last updated

Jul 26, 2022

5 Best Wealth Management Services In Singapore (2022)

Last updated

Jul 22, 2022

The 10 Commandments of Credit Cards You Should Always Follow

Last updated

Jul 22, 2022

11 Things You Shouldn’t Do Before or During a Recession

Last updated

Jul 20, 2022

Money Confessions: I Earn Less Than $1,000 Monthly, But I’m Perfectly Content — Here’s Why

Last updated

Jul 19, 2022

Cashback vs Miles vs Rewards: Which Is The Best Type Of Credit Card For You?

Last updated

Jul 13, 2022

8 Lifestyle Changes You Can Make to Better Cope With Inflation in Singapore 2022

Last updated

Jul 12, 2022

Student Credit Cards — Are They Worth Signing Up For in 2022?

Last updated

Jul 7, 2022

YouTrip Review 2022: Fees, Rates, and Promos

Last updated

Jul 6, 2022

DBS Vantage Card: Is This The Right $120K Card For You?

Last updated

Jul 5, 2022

5 Money Myths We Need to Stop Believing

Last updated

Jun 29, 2022

Best HSBC Credit Cards In Singapore (2022)

Last updated

Jun 24, 2022

The Real Cost: How Much Do I Need to Earn to Live Comfortably in Singapore?

Last updated

Jun 24, 2022

School Didn’t Teach Me: Which is More Important — Education or Experience?

Last updated

Jun 15, 2022

How to Perform a Successful Mid-Year Financial Review For Yourself in 2022

Last updated

Jun 14, 2022

18 Best Credit Cards For Big-Ticket Items

Last updated

Jun 10, 2022

Metal Credit Cards With The Best Perks (2022)

Last updated

Jun 8, 2022

Local Banks vs Foreign Banks in Singapore: Pros & Cons

Last updated

Jun 8, 2022

Cash VS Multi-Currency Cards: Pros & Cons

Last updated

Jun 6, 2022

How To Prepare For A Recession As A Working Adult In Singapore?

Last updated

Jun 6, 2022

Best Citibank Credit Cards In Singapore (2022)

Last updated

Jun 3, 2022

Best Credit Cards for S$600 Monthly Spend

Last updated

Jun 2, 2022

Priority Pass Membership 2022: Should You Sign Up?

Last updated

May 31, 2022

Best Credit Card Combinations for Post-Covid Travel

Last updated

May 30, 2022

Metal Credit Cards VS Regular Credit Cards: What’s The Difference?

Last updated

May 21, 2022

7 Reasons Why Men Should Sign Up for Women’s Credit Cards

Last updated

May 20, 2022

Best Credit Cards For Booking Flights And Hotels

Last updated

May 18, 2022

5 Tips To Better Plan Your Budget in a Post-COVID World

Last updated

May 12, 2022

Can Cashback Credit Cards Help Curb Inflation in Singapore?

Last updated

May 11, 2022

Goods and Services Tax (GST) Singapore – What Is It, Current Rates, Output Tax

Last updated

May 11, 2022

5 Credit Cards That Will Help You Save The Most Money in 2022

Last updated

May 9, 2022

Instarem’s amaze Card Review: Is It Still Amazing?

Last updated

May 4, 2022

5 Best Features Your Credit Cards Should Have

Last updated

Apr 29, 2022

What Do You Enjoy As A 60-Year-Old Senior Citizen In Singapore?

Last updated

Apr 29, 2022

9 Life-Changing Money Lessons Singaporeans Can Learn from Star Wars

Last updated

Apr 28, 2022

6 Credit Cards Which Give Free Access to Airport Lounges

Last updated

Apr 26, 2022

What’s the Difference Between Mastercard vs Visa vs American Express Credit Cards?

Last updated

Apr 26, 2022

What Is Shrinkflation and How Can You Save Money While Shopping for Groceries?

Last updated

Apr 22, 2022

Should I Use My Credit Card to Pay for Everything?

Last updated

Apr 21, 2022

Coin Deposit Machines in Singapore – Steps to Free Deposits

Last updated

Apr 21, 2022

When Should You Pay for Comfort and Convenience?

Last updated

Apr 20, 2022

Fixed Deposits vs. Endowment Plans vs. Cash Management Accounts: Which Should You Choose?

Last updated

Apr 19, 2022

The Effects of Compounding Interest – How It Works And Why It Matters To Know

Last updated

Apr 19, 2022

5 Signs It’s Time To Upgrade Your Debit Card To A Credit Card

Last updated

Apr 13, 2022

Is It Time to Fire Your Financial Advisor? These 5 Signs Say Yes

Last updated

Apr 13, 2022

Split Review: A Shariah Compliant BNPL Platform

Last updated

Apr 11, 2022

The 10 Most Popular Credit Cards Amongst Millennial SingSaver Staff

Last updated

Mar 31, 2022

The Best Credit Cards for Young Adults in Singapore (2022)

Last updated

Mar 30, 2022

Best Petrol Credit Cards in Singapore (2022)

Last updated

Mar 25, 2022

Money Confessions: I Have 16 Credit Cards But I’m Not In Debt

Last updated

Mar 25, 2022

7 Ways To Stop Living Paycheck To Paycheck In Singapore

Last updated

Mar 25, 2022

4 Major Reasons Why Your Credit Card Application Was Declined

Last updated

Mar 23, 2022

Credit Card Fraud: How to Better Protect Yourself?

Last updated

Mar 22, 2022

How To Earn Rewards and Miles for Paying Your Income Tax

Last updated

Mar 18, 2022

Best Savings Accounts & Child Development Accounts (CDA) For Kids In Singapore 2022

Last updated

Mar 16, 2022

Credit Card Comparison: UOB Absolute vs Citi Cash Back+ vs SCB Unlimited

Last updated

Mar 11, 2022

Budgeting 101: Understanding Needs vs. Wants

Last updated

Mar 11, 2022

Best Credit Cards To Use For Wedding Expenses

Last updated

Mar 8, 2022

Best Women’s Credit Cards In Singapore 2022

Last updated

Mar 4, 2022

Credit Card Interest Rate: How To Calculate Credit Card Annual Percentage Rate (APR)?

Last updated

Feb 28, 2022

Can Cancelling A Credit Card Have Detrimental Effects?

Last updated

Feb 24, 2022

Buy Now Pay Later Comparison Guide: Atome, Hoolah and Rely

Last updated

Feb 23, 2022

How To Talk About Money With Your Partner

Last updated

Feb 16, 2022

What Does The Future Of Digital Banking In Singapore Look Like?

Last updated

Feb 14, 2022

Here Are The Banks That Can Now Be Linked To Your GrabPay Wallet And How You Can Do So

Last updated

Feb 14, 2022

Should You and Your S.O. Get A Couple’s Credit Card?

Last updated

Feb 14, 2022

The Best Ways To Pay Medical Bills In Various Circumstances

Last updated

Feb 14, 2022

School Didn’t Teach Me: How To Deal With The Cost of Living in Singapore in 10 Years

Last updated

Feb 7, 2022

22 Ways to Succeed in Your Money Goals in 2022

Last updated

Feb 4, 2022

Pros And Cons Of Multi-Currency Savings Accounts

Last updated

Jan 31, 2022

Credit Card Guide to Virtual Credit Cards Singapore

Last updated

Jan 31, 2022

How To Plan Your Credit Card Strategy For The Year Ahead, According to MileLion

Last updated

Jan 27, 2022

5 Reasons Why Digital Angbaos Are The Way To Go This Chinese New Year

Last updated

Jan 27, 2022

Money Confessions: What having S$1 in my bank account taught me

Last updated

Jan 27, 2022

How the US Fed Rate Hikes Will Affect You in 2022

Last updated

Jan 22, 2022

CNY Red Packet Guide 2022: Rates, Etiquette And Everything You Need To Know

Last updated

Jan 19, 2022

Money Confessions: Top 5 Personal Finance Goals SS Staffers Aim To Check Off In 2022

Last updated

Jan 19, 2022

How To Plan And Achieve Your Financial Goals For 2022

Last updated

Jan 17, 2022

Credit Card Comparison: Amex True Cashback vs Citi Cash Back+ vs SCB Unlimited

Last updated

Jan 10, 2022

12 Financial New Year’s Resolutions for 2022

Last updated

Jan 10, 2022

School Didn’t Teach Me: How to Plan Financial New Year’s Resolutions — and Succeed at Them

Last updated

Dec 17, 2021

How To Maximise Your Rewards And Discounts On Christmas And Year-End Shopping

Last updated

Dec 15, 2021

Financial Topics That Are Safe for This Year’s Christmas/New Year Table

Last updated

Dec 9, 2021

Why I Do A Yearly Financial Review (And So Should You!)

Last updated

Dec 9, 2021

UOB Stash Account Review (2022)

Last updated

Dec 8, 2021

Best Cashback Credit Cards In Singapore (2022)

Last updated

Dec 8, 2021

Best Student Credit Cards in Singapore (2022)

Last updated

Dec 8, 2021

Credit Cards You Should Use As Your EZ-Link Card

Last updated

Dec 8, 2021

Cost Guide to Weddings in Singapore 2022

Last updated

Dec 8, 2021

How To Ask For Credit Card Annual Fee Waivers

Last updated

Dec 7, 2021

End-Of-Year Bonus: What To Do And How To Utilise It?

Last updated

Dec 7, 2021

10 Financial Resolutions To Make This 2022

Last updated

Dec 7, 2021

3 Reasons Why HSBC Everyday Global Account Is Made For Young Professionals

Last updated

Dec 1, 2021

Best CIMB Credit Cards In Singapore (2021)

Last updated

Dec 1, 2021

Best Christmas Dining Deals That Come With Your Credit Cards (2021)

Last updated

Dec 1, 2021

4 Types Of Credit Cards With Lifetime Annual Fee Waivers

Last updated

Dec 1, 2021

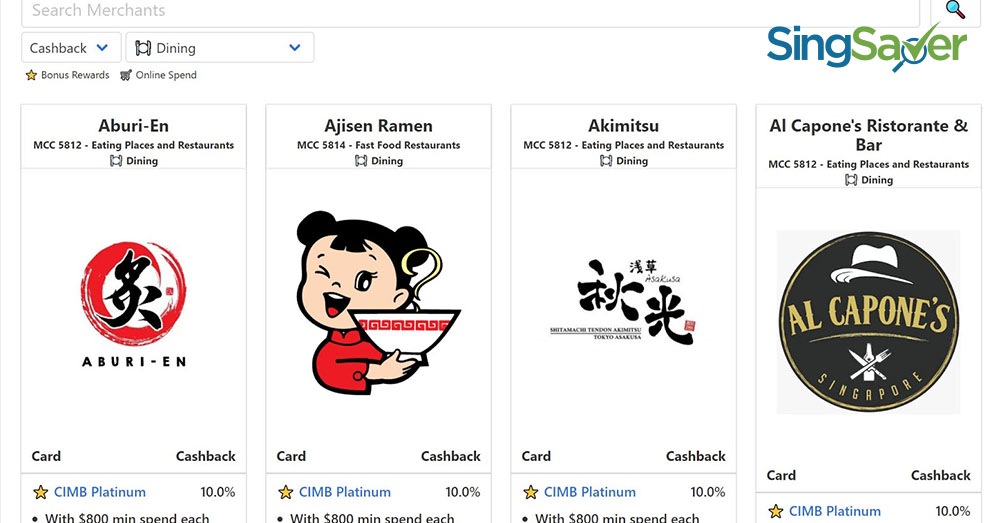

Best Dining Credit Cards In Singapore (2021)

Last updated

Dec 1, 2021

There’s A Citi Credit Card For You At Every Life Stage

Last updated

Dec 1, 2021

Is the HSBC Advance Credit Card the Best Cashback Card Right Now?

Last updated

Nov 29, 2021

Should You Combine Your Savings And Spending Account?

Last updated

Nov 24, 2021

Credit Card Comparison: DBS Live Fresh vs UOB EVOL vs OCBC FRANK

Last updated

Nov 24, 2021

Credit Card Comparison: DBS Altitude vs Citi PremierMiles vs OCBC 90N

Last updated

Nov 24, 2021

Credit Card Comparison: POSB Everyday vs Citi Cash Back vs OCBC 365

Last updated

Nov 24, 2021

5 TikTok accounts you need to follow ASAP for bite-size financial advice

Last updated

Nov 23, 2021

Opening An Offshore Bank Account In Singapore

Last updated

Nov 22, 2021

UOB EVOL Credit Card Review (2021): Made To Save Your Money And Our Climate

Last updated

Nov 22, 2021

Most Popular Credit Cards In Singapore (2021) – Benefits And Drawbacks

Last updated

Nov 22, 2021

Credit Card Comparison: UOB One vs HSBC Visa Platinum vs Citi Cash Back

Last updated

Nov 18, 2021

Credit Card Comparison: Citi Rewards vs OCBC Titanium vs HSBC Revolution

Last updated

Nov 18, 2021

Credit Card Comparison: UOB One vs CIMB Visa Signature vs BOC Family

Last updated

Nov 18, 2021

Which Credit Card Is The Best Companion For VTL Travel?

Last updated

Nov 17, 2021

Best Supplementary Credit Cards To Gift Your Partner Or Kids

Last updated

Nov 11, 2021

How Citi Credit Cards Make A Loyal Customer Out Of You

Last updated

Oct 29, 2021

Buy Now, Pay Later vs Credit Cards: Which One’s More Dangerous?

Last updated

Oct 25, 2021

3 Tips For Using ‘Buy Now, Pay Later’ Facilities Like A Real Shopping Pro

Last updated

Oct 25, 2021

Best Credit Cards Hacks To Go With Your Choice Of Buy Now, Pay Later (BNPL)

Last updated

Oct 25, 2021

Best DBS/POSB Credit Cards In Singapore (2021)

Last updated

Oct 14, 2021

Loyal DBS/POSB Customers: Which Credit Card Should You Add To Your Wallet?

Last updated

Oct 13, 2021

Best Credit Cards for Paying Utility Bills in Singapore

Last updated

Oct 13, 2021

Best USD Fixed Deposits: A Comparison Of Interest Rates (October 2021)

Last updated

Oct 11, 2021

6 Things To Know About Jobs Support Scheme (JSS)

Last updated

Oct 6, 2021

Best Online Shopping Credit Cards in Singapore (2021)

Last updated

Oct 5, 2021

Best Credit Cards For Overseas Spending In Singapore (2021)

Last updated

Oct 4, 2021

Can You Qualify For A Credit Card If You Earn Under S$30,000 A Year?

Last updated

Sep 22, 2021

How To Dodge Grab’s Newly Announced $1 Fee On GrabPay Top-ups

Last updated

Sep 21, 2021

The Differences Between Bank Account Types You Need to Know

Last updated

Sep 14, 2021

Best OCBC Credit Cards In Singapore (2021)

Last updated

Sep 3, 2021

Premium Credit Cards: Which Gives High Income Earners The Best Value?

Last updated

Sep 2, 2021

Cashier’s Order: What Is It And How To Get One?

Last updated

Sep 1, 2021

5 Reasons Why Instarem’s amaze Card Is A Game Changer For Your Pocket

Last updated

Aug 27, 2021

The Real Cost: Professionally Gaming In Singapore

Last updated

Aug 25, 2021

How To Avoid The Credit Card Trap, According To Credit Bureau Singapore

Last updated

Aug 25, 2021

Do Credit Cards Still Have A Place In Your Life?

Last updated

Aug 25, 2021

Standard Chartered Spree Card – SingSaver Review (2021)

Last updated

Aug 23, 2021

Crypto.com Visa Card Review (2021): For Cryptocurrency Enthusiasts And Investors

Last updated

Aug 18, 2021

Money Confessions: How COVID-19 Fixed My Finances

Last updated

Aug 17, 2021

Ultimate Guide To Digital Multi-Currency Accounts (2021)

Last updated

Aug 10, 2021

Debit Card Review: OCBC Plus! Visa Debit Card

Last updated

Aug 4, 2021

HSBC Everyday+ Cashback: Earn Bonus 1% Cashback On All HSBC Credit Card Spending

Last updated

Aug 2, 2021

FavePay CardLink Launches: Earn Bonus Cashback Plus Credit Card Rewards

Last updated

Jul 26, 2021

How To Earn Miles With Food Delivery Now That FoodPanda Ends Partnership With KrisFlyer

Last updated

Jul 21, 2021

CIMB FastSaver Account Review (2021)

Last updated

Jul 19, 2021

Best Credit Cards For Paying Insurance Premiums In Singapore (2021)

Last updated

Jul 16, 2021

Citi, Fave, convertCASH: New BNPL Players Enter The Singapore Market (July 2021)

Last updated

Jul 16, 2021

Plaza Premium Cuts Ties With Priority Pass. Here’s What It Means For You.

Last updated

Jul 14, 2021

Money Confessions: Are Joint Savings Accounts Relationship Wreckers Or Boosters?

Last updated

Jul 8, 2021

Miles All Locked Up From 2020? Why Not Give These Rewards A Shot?

Last updated

Jul 8, 2021

So, What’s The Difference Between PayNow And PayLah!?

Last updated

Jul 8, 2021

The Real Cost: Returning To Office

Last updated

Jul 8, 2021

The Real Cost: Working From Home (WFH) — May Surprise You

Last updated

Jul 8, 2021

Money Confessions: The Best Of Dads’ Money Hacks Since The 1970s (and Dad Jokes)

Last updated

Jul 8, 2021

Money Confessions: Why I Moved Out of My Parents’ House At 24, And How I Afford It

Last updated

Jul 8, 2021

Credit Cards For Foreigners Working And Staying In Singapore Worth Applying For

Last updated

Jul 7, 2021

Best Bill & Tax Payment Services That Still Earn You Rewards & Miles In Singapore

Last updated

Jul 6, 2021

What Is A Debit Card And How Does It Work?

Last updated

Jul 2, 2021

A Guide To Avoiding Common Money Mistakes In Singapore

Last updated

Jul 2, 2021

The Real Cost: Food Delivery In Singapore

Last updated

Jul 1, 2021

Debit Cards Versus Credit Cards in Singapore: Which Should You Use?

Last updated

Jun 30, 2021

Zig Rewards vs GrabRewards – Which Offers You Better Rebates?

Last updated

Jun 29, 2021

Best Bank Of China Credit Cards In Singapore (2021)

Last updated

Jun 23, 2021

Best Standard Chartered Credit Cards in Singapore (2021)

Last updated

Jun 23, 2021

Best American Express Credit Cards In Singapore (2021)

Last updated

Jun 22, 2021

Best Business Credit Cards In Singapore (2021)

Last updated

Jun 21, 2021

Best Premium Credit Cards In Singapore (2021)

Last updated

Jun 21, 2021

POSB Everyday Card Review: Will This Be Your Favourite Card?

Last updated

Jun 17, 2021

PAssion POSB Debit Card: The Decisive Review Guide (2021)

Last updated

Jun 15, 2021

Citi SMRT Card Review: Save 5% On Transport, Groceries & Online Shopping With No Monthly Cap

Last updated

Jun 11, 2021

MileLion Says: These Are The 5 Credit Cards I Never Leave Home Without

Last updated

Jun 11, 2021

Why Any SME Owner Should Get The AMEX Singapore Airlines Business Card

Last updated

Jun 10, 2021

Credit Cards With Free Airport Lounge Access: What You Need To Know

Last updated

Jun 8, 2021

What Are The Best Credit Cards You Should Be Paying Medical Bills With?

Last updated

Jun 4, 2021

Maybank Family & Friends Review: 8% Cashback On Your Favourite Categories

Last updated

May 28, 2021

UOB YOLO Is Now The UOB EVOL: What’s Changed?

Last updated

May 28, 2021

HSBC Revolution Credit Card Review: For Low Spenders Who Want Flexible Rewards

Last updated

May 27, 2021

Grab To Increase Base Fare By S$1 From 1 June 2021: How You Can Waive It Till 14 June

Last updated

May 25, 2021

Standard Chartered Bonus$aver Review (2021)

Last updated

May 20, 2021

Credit Card Combo: Why You Should Pair Citi PremierMiles & Citi Rewards

Last updated

May 18, 2021

Credit Cards That Supercharge Your Savings On Open Electricity Market

Last updated

May 17, 2021

Comparison: How Does PayLater By Grab Measure Up Against Other BNPL Providers?

Last updated

May 14, 2021

7 Work-From-Home Essentials For All Budgets

Last updated

May 7, 2021

UOB Launches New UOB Absolute Cashback Card: 1.7% Cashback, No Questions Asked

Last updated

May 5, 2021

Citi Rewards Card Review: Earn 10X Rewards Without Any Minimum Spend

Last updated

May 3, 2021

Citi Cash Back+ Mastercard® Card Review: 1.6% Cashback On All Spend

Last updated

May 3, 2021

Citi PremierMiles Card Review: Well-rounded Air Miles Credit Card

Last updated

May 3, 2021

Citi Cash Back Card Review: 8% Cashback On Groceries And Petrol, 6% On Dining

Last updated

Apr 26, 2021

Standard Chartered Unlimited Card Review: Fuss-Free Cashback Card

Last updated

Apr 26, 2021

Credit Card Combo: Why You Should Pair Citi Cash Back & Amex True Cashback

Last updated

Apr 23, 2021

Goodbye GrabPay: Which Credit Cards Are Most Affected?

Last updated

Apr 21, 2021

Ang Bao Rates For Singapore Weddings 2021

Last updated

Apr 21, 2021

Should You Convert Your STAR$ To KrisFlyer Miles (Or Vice Versa?)

Last updated

Apr 20, 2021

Aspire Visa Corporate Card Review: Agile, Low-cost Business Finance Management

Last updated

Apr 20, 2021

5 Habits of Super Frugal People You Should Follow If You Want To Save Money

Last updated

Apr 19, 2021

OCBC FRANK Revamp: 4 Reasons To Sign Up For This Relaunched Card

Last updated

Apr 15, 2021

Credit Card Combo: Why Pair DBS Woman’s World Card & DBS Altitude

Last updated

Apr 13, 2021

UOB Lady’s Savings Account: Free Medical Coverage For All Women

Last updated

Apr 5, 2021

HSBC’s FinFit Study: Singaporeans Worry Most About Unexpected Expenses, And Here’s How To Deal

Last updated

Apr 1, 2021

Money Confessions: I Am An Artist/e — Here’s How I Make Money From The Arts: Chen Xi

Last updated

Mar 24, 2021

American Express True Cashback Card Review (2021): 1.5% Cashback On Just About Everything

Last updated

Mar 8, 2021

Amex KrisFlyer Credit Card Review: Entry-Level Card For All Miles Beginners

Last updated

Mar 8, 2021

HSBC Revolution Card Facelift: 4 mpd, Contactless Spending And More

Last updated

Mar 8, 2021

Standard Chartered Rewards+ Review: Accelerated Points For Online & Dining Spends

Last updated

Mar 8, 2021

Credit Cards That Get You Instant Approval And Digital Cards

Last updated

Mar 8, 2021

AirAsia Food Delivery: What Credit Cards To Order With For BIG Rewards

Last updated

Mar 8, 2021

5 Things You Should Know About Credit Score

Last updated

Feb 23, 2021

GST Changes: How Does It Affect You? (2021)

Last updated

Feb 23, 2021

Singapore Budget 2021: 5 Ways It Will Affect Your Daily Life

Last updated

Feb 23, 2021

3 Reasons To Cancel Your Credit Card (And How To Do Just That)

Last updated

Feb 22, 2021

Singapore Budget 2021: Hawker Eats That Deserve Your $100 CDC Vouchers

Last updated

Feb 16, 2021

3 Key News Updates For AMEX KrisFlyer Credit Cardmembers To Know About

Last updated

Feb 15, 2021

2021 Public Transport Fare Structure And Tips On How You Can Save

Last updated

Feb 9, 2021

3 Ways DBS Altitude Card Is Still Your Go-To Miles Credit Card For The New Travel Norm

Last updated

Feb 5, 2021

Another One Bites The Dust: Major Savings Accounts Further Slash Interest Rates For 2021

Last updated

Feb 4, 2021

Step-by-Step Guide To Cheque Deposit: How To Make Sure It Doesn’t Get Bounced

Last updated

Feb 4, 2021

Google Pay: Free Cashback On PayNow Transfers And In-store Payments

Last updated

Feb 4, 2021

2021 Li Chun: Best Times On 4 February To Deposit Money

Last updated

Feb 4, 2021

Razer Fintech Launches New Visa Prepaid Card – Are You ‘1337’ Enough For It?

Last updated

Feb 3, 2021

The Four Most Exclusive Credit Cards in Singapore

Last updated

Feb 3, 2021

How Does GrabPay Mastercard Compare To Other Credit And Debit Cards?

Last updated

Feb 2, 2021

Money Confessions: These 11 Horror Stories Will Get You ‘Woke’ About Your Personal Finance

Last updated

Jan 31, 2021

Samsung Pay and Samsung Rewards: All The Cool Stuff You’re In For

Last updated

Jan 28, 2021

9 Best Budgeting Apps To Save Your Way To Success

Last updated

Jan 24, 2021

5 Tips For Millennials To Start Adulting Financially

Last updated

Jan 22, 2021

Why Citi PremierMiles may be the most useful miles card in Singapore

Last updated

Jan 20, 2021

CNY Ang Bao Rates and Rules No One Tells You About (2021)

Last updated

Jan 15, 2021

Digibank Apps: Which Bank Has The Best All-In-One Experience?

Last updated

Jan 14, 2021

Where And How to Get New Bank Notes For CNY 2021

Last updated

Jan 14, 2021

4 Things To Do Immediately If Your Credit Card Details Get Stolen

Last updated

Jan 13, 2021

DBS Altitude Card Review: Fulfill Wanderlusts With Expiry-free Miles

Last updated

Jan 12, 2021

Planning A Wedding? Here’s How To Earn The Most Miles Possible

Last updated

Jan 11, 2021

Get Instant Credit Card Approval with Standard Chartered Bank

Last updated

Jan 11, 2021

Guide To Vet Clinics In Singapore: How Much Does It Cost To Treat Your Sick Pets

Last updated

Jan 11, 2021

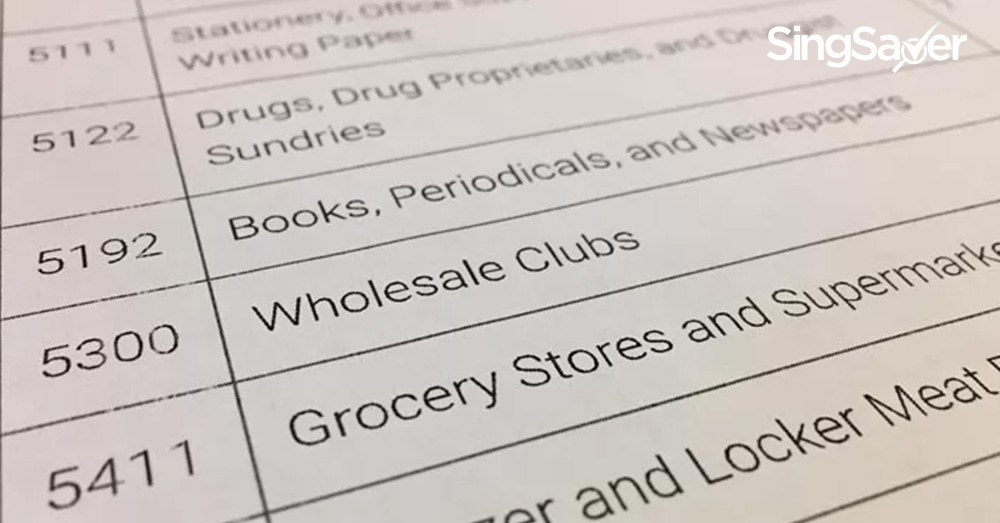

Visa Supplier Locator: Find And Decode Any Credit Card MCC

Last updated

Jan 8, 2021

SingSaver Exclusive: Have You Gotten Your Free Copy Of The Ultimate Savings Guide?

Last updated

Jan 8, 2021

6 Credit Card Resolutions To Nail 2021

Last updated

Jan 5, 2021

Are You Making The Most Of Your Credit Card Points?

Last updated

Jan 4, 2021

OCBC 365 Credit Card Review (2021): A Cashback Card For Day-To-Day Spending

Last updated

Jan 4, 2021

OCBC Titanium Rewards Card: One Shopping Card You’ll Want In Your Wallet

Last updated

Jan 4, 2021

5 Essential Tips To Get Rid Of Debt As You Enter 2021

Last updated

Dec 29, 2020

Millennials Have Spoken: These Are The Worst Money Worries This Year In 2020

Last updated

Dec 22, 2020

11 Ways To Prepare Yourself For A Recession During COVID-19

Last updated

Dec 22, 2020

SingapoRediscovers Vouchers: Which Credit Cards Should You Use?

Last updated

Dec 16, 2020

How To Level Up Your Financial Planning With SGFinDex

Last updated

Dec 15, 2020

Do You Know What Goes On Your Credit Report?

Last updated

Nov 30, 2020

Worried About KrisFlyer Miles Expiring Soon? Singapore Airlines Extends Them

Last updated

Nov 11, 2020

What Are The Best Credit Cards For Paying Education Expenses?

Last updated

Nov 11, 2020

3 Best E-Commerce Credit Cards For Your Online Shopping Sprees

Last updated

Nov 9, 2020

Should You Get A Credit Card When You Start A Job?

Last updated

Oct 29, 2020

12 Things You Can Buy With The Money Spent On An iPhone 12

Last updated

Oct 26, 2020

DBS Woman’s World Card Review: Does it Deliver What Women Want?

Last updated

Oct 19, 2020

The New KrisFlyer UOB Credit Card: The Good, The Bad and the Ugly

Last updated

Oct 19, 2020

Are The Singapore Airlines Experiences Worth Your Money Or Air Miles?

Last updated

Oct 9, 2020

All You Need To Know About The New Singtel Dash Rewards Program

Last updated

Oct 6, 2020

Best Credit Cards To Power Up Interest Rate On Your Savings Account (2020)

Last updated

Oct 1, 2020

How Will (The Extended) COVID-19 Support Grant Help You Financially?

Last updated

Sep 30, 2020

Maximise Your Miles On Everyday Spending With These Credit Cards

Last updated

Sep 22, 2020

Maybank Horizon Visa Signature Review: Amass Miles Over Dining And Regular Commutes

Last updated

Sep 14, 2020

Miles Credit Card Comparison: What’s Good For First-Time Miles Chasers?

Last updated

Sep 1, 2020

BOC Family Card Review: Upsized Cashback On Your Family Outings

Last updated

Aug 31, 2020

UOB PRVI Miles Credit Card Review (2020): Entry-level Pick For Privy Travellers

Last updated

Aug 28, 2020

Dining, Shopping, Workshops: Other Ways To Redeem KrisFlyer Miles This Year

Last updated

Aug 17, 2020

Credit Cards With The Best Dining Perks

Last updated

Aug 7, 2020

4 Tips For University Graduates To Clear Tuition Fee Loans Quickly

Last updated

Jun 30, 2020

5 Hidden Ways Your Credit Score Can Affect Your Life

Last updated

Jun 24, 2020

How Can You Earn Miles When Paying Tuition Fees?

Last updated

Jun 2, 2020

Use These 6 Credit Cards To Pay For Your Grab Rides In 2020

Last updated

Jun 2, 2020

OCBC Credit Cards: 3 Important Changes Cardholders Need To Know

Last updated

May 8, 2020

How Does COVID-19 Change Your Miles Strategy?

Last updated

Apr 27, 2020

COVID-19: Why Now Is Not The Time To Buy Miles

Last updated

Apr 21, 2020

American Express Singapore Airlines KrisFlyer Ascend Review: A Hint Of Luxury For Miles-chasers

Last updated

Apr 21, 2020

Netflix, Spotify, GrabFood, XBox: Best Credit Cards For Online Subscriptions

Last updated

Apr 16, 2020

Travel Cancelled Due To COVID-19? Here’s How To Save Your Expiring Airline Miles

Last updated

Apr 14, 2020

Can’t Fly Due To COVID-19 Circuit Breaker? Here’s What To Do With Your KrisFlyer Miles

Last updated

Apr 13, 2020

vPost v comGateway v ezbuy v Buyandship Singapore: Cheapest Shipping From US to Singapore

Last updated

Mar 31, 2020

Credit Card Benefits You Didn’t Know You Had

Last updated

Mar 16, 2020

EZ-Link vs EZ-Reload vs SimplyGo: Best Option To Pay For Public Transport

Last updated

Mar 16, 2020

GrabRewards Devaluation: Is It Still Worth The Hassle?

Last updated

Mar 5, 2020

10 Prudent Things You Can Do With Your Travel Fund If COVID-19 Has Derailed Your Trip

Last updated

Mar 5, 2020

What Your MBTI Type Says About Your Money Habits

Last updated

Mar 4, 2020

How Can I Earn Miles And Points On Insurance Payments?

Last updated

Feb 25, 2020

Grab To Slash Rewards For Rides, Food Delivery And Shopping

Last updated

Feb 24, 2020

How Singapore Budget 2020 Affects HDB, CPF & Living Costs

Last updated

Feb 19, 2020

5 Hacks To Upgrade Your Budget Flight With Credit Cards

Last updated

Feb 10, 2020

OCBC 90°N Credit Card Review: Pros and Cons and Should You Get It?

Last updated

Jan 31, 2020

Which Are The Best Millennial Credit Cards?

Last updated

Jan 13, 2020

Financial Goals For 2020 By Your Age: 20s, 30s, 40s, 50s

Last updated

Dec 31, 2019

8 DBS Cards That Every Miles Chaser Should Consider

Last updated

Dec 23, 2019

How To Allocate Your Cash Effectively

Last updated

Dec 20, 2019

Should I Use A Credit Card Or Multi-Currency Card For Overseas Spending?

Last updated

Dec 16, 2019

12 Biggest Spending Watchouts in Singapore

Last updated

Dec 6, 2019

When Should You Open A Second Bank Account?

Last updated

Nov 19, 2019

The Best Bank Accounts For Miles Chasers

Last updated

Nov 18, 2019

SC EasyBill Vs Citi PayAll: Which Is Better?

Last updated

Oct 7, 2019

The Best Miles Cards… May Be Rewards Cards

Last updated

Sep 29, 2019

‘I Have 19 Credit Cards But There’s Just 3 I Would Recommend Anyone to Have’

Last updated

Sep 29, 2019

Best 6 Credit Cards For Overseas Spending

Last updated

Sep 29, 2019

Which Credit Cards Offer Free Travel Insurance in Singapore?

Last updated

Sep 28, 2019

4 Questions To Ask Before Requesting For A Credit Card Annual Fee Waiver

Last updated

Sep 23, 2019

Amex, Visa, or Mastercard: Which is Best for Travel?

Last updated

Sep 21, 2019

4 Student Credit Cards That Also Earn You Miles and Cashback

Last updated

Sep 13, 2019

Air Miles Cards: 8 Questions To Help You Choose the Right Card

Last updated

Sep 1, 2019

6 Ways to Turbocharge Your Travel Hacking Game

Last updated

Sep 1, 2019

What’s A Hassle-free Way To Pay Overseas?

Last updated

Aug 30, 2019

Current Account, Savings Account (CASA) Singapore: Complete 2019 Guide

Last updated

Aug 28, 2019

AMEX-SIA Business Credit Card: How Does It Stack Up Against Other Corporate Cards?

Last updated

Aug 21, 2019

Here’s How to Redeem KrisFlyer Miles On Over 30 Partner Airlines

Last updated

Aug 19, 2019

5 Hacks to Rack Up Miles and Make Business Travel Less Painful

Last updated

Aug 6, 2019

Dining Credit Cards To Get In Singapore 2019

Last updated

Aug 1, 2019

How To Earn Miles On MRT And Bus Rides With SimplyGo

Last updated

Jul 31, 2019

StanChart Launches X Card With Revised Offer of 60,000 Bonus Sign-Up Miles

Last updated

Jul 31, 2019

4 Questions To Ask Before Applying for Supplementary Cards as a Couple

Last updated

Jul 25, 2019

When Should You Lower Your Credit Limit?

Last updated

Jul 21, 2019

What Are The Best Ways To Pay For Big-Ticket Items in Singapore?

Last updated

Jul 20, 2019

Cashback or Rewards Credit Cards: Which is Better?

Last updated

Jul 19, 2019

5 Hacks to Avoid Expensive Credit Card Late Payment Fees

Last updated

Jul 19, 2019

Amex Krisflyer Blue Vs Ascend: Which Is the Right Card for You?

Last updated

Jul 18, 2019

WhatCard.sg Helps Consumers Maximise Credit Card Rewards Right Before They Pay

Last updated

Jul 15, 2019

MCC: The Three Most Important Letters When Earning Air Miles (or Cashback)

Last updated

Jul 8, 2019

Help! My Credit Card Points Are About To Expire!

Last updated

Jul 1, 2019

How to Pick a Savings Account (When They All Look the Same)

Last updated

May 9, 2019

7 Good Reasons to Change Your Savings Account

Last updated

May 7, 2019

7 Ways To Earn More Miles With Everyday Expenses

Last updated

May 6, 2019

Battle of Cards: The Ultimate Fight for the Best Credit Cards in Singapore

Last updated

Apr 30, 2019

HSBC Advance Review: The Bank Account That Grows With You

Last updated

Apr 24, 2019

How To Redeem Miles for Friends and Family

Last updated

Apr 22, 2019

OCBC FRANK Credit Card: The Perfect Card for Millennials?

Last updated

Apr 16, 2019

5 Money Lessons We Can All Learn From Game of Thrones

Last updated

Apr 13, 2019

5 Things to Know When Graduating From Debit to Credit Cards

Last updated

Apr 11, 2019

Does Playing the Miles Game Affect Your Credit Score?

Last updated

Mar 25, 2019

Financial Planning for Women: 4 Things to Do Right Now for Better Financial Health

Last updated

Mar 25, 2019

When Does It Make Sense To Pay Your Credit Card Annual Fee?

Last updated

Mar 18, 2019

Singapore Startup Disrupting How You Pay Rent, Taxes and Insurance Premiums

Last updated

Mar 6, 2019

‘How I Saved 25% in 48 Hours With Grab’s Commute Plan (Lite)’

Last updated

Mar 4, 2019

Accelerated Upgrade to KrisFlyer Elite Gold for AMEX Ascend Cardholders

Last updated

Mar 1, 2019

Enjoy More Travel Getaways With Free Flights And Affordable Insurance Coverage

Last updated

Feb 12, 2019

5 Things To Love About OCBC 365 Credit Card

Last updated

Feb 1, 2019

3 Air Miles Credit Cards With the Best Bonus Miles Offers

Last updated

Feb 1, 2019

The Best Shopping Credit Cards In Singapore 2020

Last updated

Feb 1, 2019

Here’s Why You Should Never Use Air Miles Redemption for Economy Class

Last updated

Jan 31, 2019

How Age Changes the Way You Think About Money

Last updated

Jan 31, 2019

Credit Card Signup Bonuses: How to Maximise Miles with Big Ticket Spending

Last updated

Jan 23, 2019

You’re Only 3 Steps From A $1,000 Cash Ang Pow This Chinese New Year

Last updated

Jan 14, 2019

Declutter Your Life by Cleaning Out Your Credit Cards

Last updated

Jan 11, 2019

Air Miles vs Cash Back: Will You Be On the Winning Team?

Last updated

Jan 7, 2019

Cashback vs Miles: ‘Why I’m Team Cashback and Proud of It’

Last updated

Dec 19, 2018

Money Scripts: How They Affect Your Relationship With Money

Last updated

Dec 14, 2018

Best Credit Cards For Free Parking in Singapore

Last updated

Nov 27, 2018

Getting Started on the Path to Financial Wellness

Last updated

Nov 14, 2018

Simplify Your Life with the HSBC Advance Account

Last updated

Nov 13, 2018

How Do You Value An Air Mile?

Last updated

Nov 12, 2018

‘Why I Prefer Miles Over Cashback Cards Any Day, Every Day’

Last updated

Oct 28, 2018

HSBC Visa Infinite: The Best Premium Credit Card in Singapore?

Last updated

Oct 9, 2018

Best Credit Cards for Movies in Singapore

Last updated

Oct 9, 2018

All the Different Grab Rides You Can Use

Last updated

Oct 4, 2018

HSBC Visa Infinite Card Review: First-Class Premium Travel Card

Last updated

Sep 26, 2018

Should I Use Credit Cards Overseas to Earn Miles?

Last updated

Sep 1, 2018

Top 10 Dining Deals in Singapore This September

Last updated

Aug 29, 2018

The Fundamentals of Financial Readiness

Last updated

Jul 13, 2018

Everything You Need To Know About Union Pay

Last updated

Jul 3, 2018

The Dos And Don’ts Of Having A Credit Card (Or Two, Or Three)

Last updated

Jul 2, 2018

And The Best Credit Cards With Travel Insurance Are…

Last updated

Jun 22, 2018

The Beginner’s Guide To Earning Air Miles

Last updated

Jun 13, 2018

5 Things You Didn’t Know Air Miles Can Buy

Last updated

Jun 12, 2018

Pros and Cons of Using a Mobile Wallet

Last updated

May 8, 2018

How Much Should You Keep in Your Mobile Wallet?

Last updated

May 3, 2018

What Do Millennials Do With Their First Pay Check?

Last updated

Apr 24, 2018

Money Matters That Work Differently In Singapore

Last updated

Mar 20, 2018

Money Concerns of Freelancers (And How to Solve Them)

Last updated

Mar 16, 2018

5 Reasons Why Credit Cards Aren’t as Dangerous as You Think

Last updated

Mar 14, 2018

4 Ways to Use Fixed Deposits (You Never Knew About)

Last updated

Mar 1, 2018

5 Types of People Who Should Use E-Wallets

Last updated

Mar 1, 2018

5 Immediate Ways That Budget 2018 Will Affect You

Last updated

Feb 22, 2018

5 Best Ways to Save Your Ang Pow Money

Last updated

Feb 13, 2018

How to Get Your Budget Back on Track After a Splurge

Last updated

Feb 13, 2018

12 Financial Goals for the Next 12 Months

Last updated

Jan 24, 2018

Get S$390 Worth of Free Gifts When You Apply for These Hand-picked Credit Cards

Last updated

Jan 19, 2018

7 Money Facts Every Singaporean Should Know by the Time They Turn 18

Last updated

Jan 17, 2018

7 Things Millennials Don’t Seem to Know About Credit Cards (But Should)

Last updated

Jan 2, 2018

5 Ways to Prepare for the GST Hike (That is Most Probably Coming)

Last updated

Dec 27, 2017

5 Ways to Track and Control Your Spending (For Beginners)

Last updated

Dec 26, 2017

5 Unexpected Things That Affect Your Ability to Save Money

Last updated

Dec 11, 2017

5 Alasan Untuk Membuka Rekening Bank di Singapura (Walaupun Anda tidak tinggal di sana)

Last updated

Nov 9, 2017

Money Habits We Can Learn From Millennials

Last updated

Nov 9, 2017

5 Reasons to Open a Bank Account in Singapore (Even if You Don’t Live There)

Last updated

Nov 5, 2017

7 Best Eateries to Use Your Amex Love Dining Privileges

Last updated

Nov 1, 2017

Use Conscious Spending To More Easily Afford Satisfying Purchases

Last updated

Oct 17, 2017

Why It Might Be Time To Switch Bank Accounts

Last updated

Oct 6, 2017

Keep An Eye On Your Credit Score To Prevent Falling Victim To Fraud

Last updated

Oct 2, 2017

Exclusive Offer: Get 5% Off My Credit Monitor 1-year Subscription to Protect Against Fraud

Last updated

Sep 29, 2017

5 Small Money Habits That Put You Ahead of Your Peers

Last updated

Sep 25, 2017

Earn a Free Trip to Bangkok With Your Renovation Spending!

Last updated

Sep 22, 2017

Get a Free Round-trip to Bali on Singapore Airlines with American Express

Last updated

Sep 18, 2017

Top 3 Credit Cards to Save Money on iPhone X, 8 and 8 Plus

Last updated

Sep 14, 2017

Why You Can’t Seem to Save Money (or Lose Weight)

Last updated

Aug 31, 2017

Breaking: Get Instant Approval Now for Citi Credit Cards

Last updated

Aug 29, 2017

Four Money Goals To Meet In Your 20s

Last updated

Aug 21, 2017

Money Advice You Wish You’d Told Your 18-year-old Self

Last updated

Aug 16, 2017

Are Credit Cards in Singapore Good or Bad?

Last updated

Aug 10, 2017

How Does Credit Card Fraud Happen in Singapore?

Last updated

Aug 8, 2017

10 Weird Things You Can Actually Be Fined For in Singapore

Last updated

Aug 7, 2017

Use These 4 Cash Tricks to Increase Your Savings by 20%

Last updated

Aug 3, 2017

Your Attitude Towards Money Needs to Change When You’re 35 Years Old

Last updated

Aug 3, 2017

Column: How To Coach Yourself To Save An Extra S$500 Every Month

Last updated

Jul 31, 2017

9 Signs You Have a YOLO Attitude Towards Money

Last updated

Jul 26, 2017

Column: Why Credit Cards Are Not Money

Last updated

Jul 14, 2017

Why It’s Better to Use Credit Cards Instead of In-Store Credit

Last updated

Jul 5, 2017

20 Money Habits Singaporeans Should Have By Age 30

Last updated

Jun 30, 2017

PayNow Lets You Send Cash with Just a Mobile or IC Number

Last updated

Jun 29, 2017

ANZ Becomes DBS: Everything You Need to Know About the Handover

Last updated

Jun 28, 2017

The Best Air Miles Credit Cards in Singapore for 2017

Last updated

Jun 28, 2017

Best Credit Cards for Online Shopping in Singapore

Last updated

Jun 28, 2017

The Very Best Credit Cards in Singapore for 2017

Last updated

Jun 28, 2017

7 Ways Laziness Costs Singaporeans Hundreds of Dollars Each Month

Last updated

Jun 23, 2017

7 Golden Rules to Managing Your Money Like An Adult

Last updated

Jun 22, 2017

Money Mysteries: How Do Banks “Create” Money?

Last updated

Jun 21, 2017

Why Giving Up Avocado Toast Won’t Bring You Financial Freedom

Last updated

Jun 20, 2017

Column: Why Future-Oriented Thinking Sabotages Your Savings

Last updated

Jun 9, 2017

How Much Do We Actually Spend on Grab and Uber in Singapore?

Last updated

Jun 2, 2017

The Broke Girl’s Guide to Surviving with Credit Card Points

Last updated

May 29, 2017

How Your Mobile Phone Makes You Spend More Money

Last updated

May 25, 2017

Emergency Moves to Make If You’re Broke Before the Next Payday

Last updated

May 18, 2017

Don’t Waste Money On These 4 “Natural” Products

Last updated

May 17, 2017

Interview: Kersie Koh, Clozette Co-Founder

Last updated

May 12, 2017

How 30-Somethings Can Tell If They’ll Be Broke By 60

Last updated

May 11, 2017

Clash of the Cashback Cards: Standard Chartered vs American Express

Last updated

May 8, 2017

Here’s How Much Credit Card Companies Pay to Give You Air Miles

Last updated

Apr 28, 2017

Should You Use the KrisFlyer UOB Debit Card to Earn Miles?

Last updated

Apr 19, 2017

How to Recover From an Impulsive Shopping Spree

Last updated

Apr 17, 2017

15 Ways You’re Secretly Sabotaging Your Own Finances

Last updated

Apr 5, 2017

Save as Much as You Can – It Matters More Than the Returns

Last updated

Apr 5, 2017

Amex is Giving Out 10K Bonus Miles on the KrisFlyer Credit Card!

Last updated

Apr 4, 2017

7 Money Lessons From 3 Failed Businesses in Singapore

Last updated

Apr 4, 2017

Why You Should Open an Offshore Banking Account in Singapore

Last updated

Apr 3, 2017

Column: Why Do Banks Have Different Interest Rates?

Last updated

Mar 28, 2017

14 Credit Card Mistakes You Didn’t Know You’re Making

Last updated

Mar 28, 2017

Instant Gratification is Personal Finance’s Number One Enemy

Last updated

Mar 27, 2017

When Does It Make Sense to Rent Designer Clothing in Singapore?

Last updated

Mar 21, 2017

Interview: Shireena Shroff Manchharam, House of Sheens

Last updated

Mar 14, 2017

12 Ways Singaporean Households Can Save Money on Water Bills

Last updated

Mar 8, 2017

20 Ridiculously Simple Ways to Save More Money in Singapore

Last updated

Mar 3, 2017

Pay Small By American Express: Should Singaporeans Use It?

Last updated

Mar 3, 2017

3 Easy Money Saving Habits You Can Set in Minutes

Last updated

Feb 23, 2017

11 Things You’ve Been Paying Too Much For When You Can Get It For Free

Last updated

Feb 23, 2017

KrisFlyer vs Asia Miles – Which is the Better Frequent Flyer Programme?

Last updated

Feb 20, 2017

When Should You Use a Credit Card Instalment Plan?

Last updated

Feb 14, 2017

Don’t Let Social Pressure Make You Overspend for Valentine’s Day

Last updated

Feb 9, 2017

The Financial Benefits of Being Single in Singapore

Last updated

Feb 8, 2017

Better Ways to Spend Your Ang Bao Money in 2017

Last updated

Jan 31, 2017

Why You Should Date Someone Who’s Poorer Than You

Last updated

Jan 31, 2017

Having Hobbies in Singapore Can Help You Save Money

Last updated

Jan 24, 2017

Credit Card Myths Singaporeans Should Stop Believing

Last updated

Jan 19, 2017

How to Get Addicted to Saving Money

Last updated

Jan 11, 2017

Should You Give Your Girlfriend a Supplementary Credit Card?

Last updated

Jan 6, 2017

The 30-Day Money-saving Challenge That’ll Make You Rich(er) In 2017

Last updated

Dec 28, 2016

Finance Experts Tell Us Their 7 Resolutions for 2017

Last updated

Dec 27, 2016

How to Survive on a Budget While Learning a New Skill

Last updated

Dec 21, 2016

What Should I Do If My Credit Card Gets Stolen in Singapore?

Last updated

Dec 16, 2016

The 5 Best Ways to Spend Your Year-End Bonus in Singapore

Last updated

Dec 14, 2016

3 Brilliant Reasons to Get a DBS Altitude Visa Signature Card

Last updated

Dec 13, 2016

These Are the Best Credit Cards for Fresh Graduates in Singapore

Last updated

Dec 13, 2016

How to Save Money and Have a Blast at ZoukOut 2016

Last updated

Dec 7, 2016

Infographic: How Do Singaporeans Save Money When They Shop Online?

Last updated

Dec 6, 2016

Why These Common Superstitions in Singapore Make You Spend More

Last updated

Dec 6, 2016

7 Signs You’re Living Beyond Your Means in Singapore

Last updated

Nov 18, 2016

How Can Singaporeans Stop Living Paycheque to Paycheque?

Last updated

Nov 14, 2016

How Many Credit Cards Should Singaporeans Really Own?

Last updated

Nov 10, 2016

There’s No Excuse For Not Having Savings in Singapore

Last updated

Nov 9, 2016

How To Survive Your Overseas Exchange Programme Without Going Broke

Last updated

Oct 31, 2016

How Much Should Singaporeans Spend on Gifts In A Year?

Last updated

Oct 13, 2016

4 Daily Habits That Cost Singaporeans Thousands of Dollars

Last updated

Oct 12, 2016

The Best Credit Cards for Large Purchases in Singapore

Last updated

Oct 7, 2016

3 Free Things in Singapore That Aren’t Really Free

Last updated

Oct 6, 2016

Why Life in Singapore is More Expensive When You’re Single

Last updated

Oct 6, 2016

Which Air Miles Credit Card are You?

Last updated

Oct 5, 2016

How Much Money Can You Save By Canceling Forgotten Subscriptions?

Last updated

Oct 5, 2016

How to Get a Credit Card in Singapore When You Have No Credit Score

Last updated

Oct 3, 2016

7 Ways Your Family Can Save More with the POSB Everyday Card

Last updated

Oct 1, 2016

Why Superficial Singaporeans Waste More Money

Last updated

Sep 28, 2016

When Are Fixed Deposits Better Than Singapore Savings Bonds?

Last updated

Sep 26, 2016

Can Singaporeans Actually Save Money With Credit Cards?

Last updated

Sep 26, 2016

Check Your Confirmation Bias Before You Make Bad Money Decisions

Last updated

Sep 23, 2016

5 Books About Money Singaporeans Should Read This Weekend

Last updated

Sep 23, 2016

How Saving Money Lets Singaporeans Save Face

Last updated

Sep 22, 2016

Why Brand Loyalty Makes Singaporeans Spend More Money

Last updated

Sep 22, 2016

How Any Singaporean Can Afford To Travel Every Year

Last updated

Sep 16, 2016

The #Girlboss Guide On How To Be Good With Your Money

Last updated

Sep 15, 2016

How Singaporeans Can Enjoy Hobbies Without Going Broke

Last updated

Sep 9, 2016

How to (Legally) Avoid Paying Credit Card Interest in Singapore

Last updated

Sep 5, 2016

Why Is It So Difficult to Control Your Spending?

Last updated

Aug 19, 2016

6 Money Attitudes That Keep Singaporeans Poor

Last updated

Aug 16, 2016

How Much Does it Cost to Get Over a Breakup in Singapore?

Last updated

Aug 16, 2016

How to Save Money Even If You Have Credit Card Debt

Last updated

Aug 11, 2016

How Will VendCafes in Singapore Impact Your Wallet?

Last updated

Aug 8, 2016

How Free Mobile Games Like Pokemon Go Make Singaporeans Spend

Last updated

Jul 13, 2016

6 Money Habits Singaporeans Must Master Before Getting a Credit Card

Last updated

Jul 12, 2016

Which Credit Card is the Best for Overseas Dining?

Last updated

Jun 28, 2016

6 Places to Get Money Exchanged in Singapore (Besides Money Changers)

Last updated

Jun 28, 2016

Episode 2: Which Cashback Credit Card Should We Use?

Last updated

Jun 27, 2016

Charge Cards Versus Credit Cards in Singapore: What’s the Difference?

Last updated

Jun 16, 2016

7 Expensive Things Singaporeans Shouldn’t Save Money On

Last updated

Jun 14, 2016

Money Mantra Podcast: Check Your Credit Report Once a Year

Last updated

Jun 13, 2016

7 Things Singaporeans Get Wrong about Gold Diggers

Last updated

Jun 7, 2016

Should Teenagers in Singapore Have Credit Cards?

Last updated

May 30, 2016

Money Mantra Podcast: You Only Need 2 Credit Cards

Last updated

May 26, 2016

Standard Chartered Visa Infinite Card Review

Last updated

May 6, 2016

Why Should You Pay Your Credit Card’s Annual Fee?

Last updated

Apr 20, 2016

4 Reasons to Pay Back Your Student Credit Card

Last updated

Apr 12, 2016

6 Singapore Bars That Offer Free Drinks with Amex Platinum Credit Card

Last updated

Apr 4, 2016

6 Ways Budget 2016 Makes Life Better for the Average Singaporean

Last updated

Mar 29, 2016

7 Clever Ways to Use Your GST Voucher

Last updated

Mar 26, 2016

What Does it Cost to Be a Singaporean Digital Nomad?

Last updated

Mar 21, 2016

How to Build a Robust Emergency Fund in Singapore

Last updated

Mar 14, 2016

5 Ways to Save Money with the American Express True Cashback Card

Last updated

Mar 14, 2016

5 Most Exciting Citi Cash Back Dining Deals

Last updated

Feb 23, 2016

How Much Will You Spend on a Sick Dog in Singapore?

Last updated

Feb 16, 2016

4 Most Straightforward Credit Cards in Singapore

Last updated

Feb 3, 2016

11 Silly Myths Singaporeans Without Credit Cards Believe In

Last updated

Jan 29, 2016

How One Credit Card Unlocks Infinite Travel Privileges

Last updated

Jan 27, 2016

4 Bad Financial Habits Singaporean Millenials Need to Outgrow

Last updated

Jan 20, 2016

5 Common Problems with Offshore Banking (And What to Do About Them)

Last updated

Jan 5, 2016

The Worst Purchases We Made in 2015

Last updated

Dec 23, 2015

Everything You Need to Know About Air Miles Credit Card Fees in Singapore

Last updated

Dec 18, 2015

How to Make Budget Apps Work Even When You Have No Discipline

Last updated

Dec 17, 2015

5 Money Matters to Wrap Up Before 2016 Starts

Last updated

Dec 16, 2015

Free eBook: 100 Ways to Save Money in Singapore

Last updated

Dec 10, 2015

Can You Pass This 5-Question Financial Literacy Test?

Last updated

Dec 2, 2015

How to Decode Your Credit Card’s Confusing Fine Print

Last updated

Nov 24, 2015

5 Logical Reasons to Stop Being Afraid of Credit Cards

Last updated

Nov 17, 2015

4 Reasons to Wish You Qualified for Singapore’s Most Exclusive Credit Cards

Last updated

Nov 16, 2015

Do You Pay More to Use NETS On a Credit Card?

Last updated

Nov 10, 2015

6 Important Features of a Reliable Offshore Bank

Last updated

Nov 9, 2015

How to Earn 93,000 Miles with the UOB PRVI Miles Card

Last updated

Nov 2, 2015

INFOGRAPHIC: 9 Ways to Go Broke on the Way to Work

Last updated

Oct 29, 2015

How to Save S$1,200 a Year with the UOB One Card

Last updated

Oct 26, 2015

4 Easy Ways to Stop Impulse Shopping in Singapore

Last updated

Oct 22, 2015

4 Ways to Save Despite the Weakening Singapore Dollar

Last updated

Oct 21, 2015

How to Save Money While Battling the Singapore Haze

Last updated

Oct 21, 2015

5 Reasons to Save Money (Besides Buying Expensive Stuff)

Last updated

Oct 14, 2015

Can You Get a Credit Card on Low or No Income?

Last updated

Oct 13, 2015

7 Money Saving Tips for the Very Lazy

Last updated

Oct 8, 2015

How to Save Money While Clubbing in Singapore

Last updated

Oct 1, 2015

3 Valuable Tips for First-Time Credit Card Owners

Last updated

Sep 29, 2015

How to Travel Business Class for Free

Last updated

Sep 23, 2015

How to Earn Air Miles Without Boarding a Plane

Last updated

Sep 17, 2015

7 Mind Tricks to Control Your Credit Card Spending

Last updated

Sep 11, 2015

5 Types of Singaporeans Who Are Missing Out on Cashback Credit Cards

Last updated

Aug 28, 2015

The 5-Step Approach to Shaving 50% Off Your Monthly Expenses

Last updated

Aug 21, 2015

4 Ways for Singaporean Millenials to Avoid Lifestyle Inflation

Last updated

Aug 18, 2015

50 Painless Ways to Save Money in Singapore

Last updated

Aug 5, 2015

Rack Up Air Miles with Credit Cards in 3 Simple Steps

Last updated

Jul 15, 2015

3 Credit Cards with the Most Amazing Welcome Gifts in the Market

Last updated

Jul 7, 2015

When is a Debit Card More Dangerous than a Credit Card?

Last updated

Jul 6, 2015

5 Money-Saving Methods That Don’t Work

Last updated

Jul 2, 2015

The 3 Credit Cards We Should Have that Don’t Exist Yet

Last updated

Jul 1, 2015

5 Great Reasons to Own a Credit Card in Singapore

Last updated

Jun 30, 2015

Want to Fly for Free? 4 Rules for Using an Air Miles Credit Card

Last updated

Jun 25, 2015

How to Get Money Back on Purchases with a Cashback Credit Card

Last updated

Jun 22, 2015

How to Get Discounts All the Time with a Rewards Credit Card

Last updated

Jun 19, 2015

How to Borrow for Free with a Credit Card

Last updated

Jun 16, 2015

Our Mission

We'll help you make your next financial move the right one.

.png)

.png)

.png)

.png)

.png)

.png)

-1.jpg)

-1.png)